Aktueller Kurs historische Performance Meinungen und Bewertung. The Vanguard Intermediate-Term Bond ETF BIV holds US government debt and similar types of high-quality fixed income.

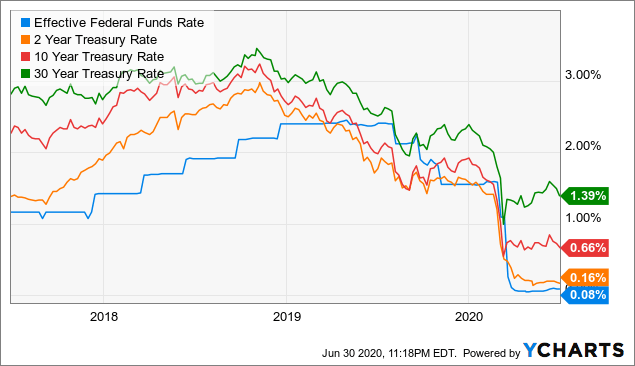

Opinion No The Fed And Bond Market Aren T Interchangeable Marketwatch

Opinion No The Fed And Bond Market Aren T Interchangeable Marketwatch

Put another way one bond fund can be considered a basket of dozens or hundreds of underlying bonds holdings within one bond portfolio.

Federal bond funds. Depending on the investment policies bond funds can consist of government bonds municipal bonds corporate bonds and mortgage-backed securities. Based on your financial goals you can invest in. In addition to mutual funds such as Vanguard Short-Term Bond Index Fund Admiral Shares VBIRX T.

Specifically as part of the stimulus effort to counteract the effects of the coronavirus lockdowns the Treasury gave the Fed. The fund has an expense ratio of 052 as compared to category average of 056. The government bond mutual fund returned 135 over the last one year period.

The redemption price will be in Indian Rupees based on previous weeks Monday-Friday simple average of closing price of gold of 999 purity published by the Indian Bullion and Jewellers Association Ltd IBJA. Bond funds definition. Spread out your exposure to risk.

The Federal Reserve is now buying bond exchange-traded funds ETFs. Nach Auslandsbonds Baby Bonds Government Bonds Mortgage Bonds Zero Bonds. 27 Zeilen Government Bonds ETFs offer investors exposure to fixed income securities issued.

This means that municipal bond. There are various general and thematic mutual funds. Many short-term bond mutual funds offer check.

Ein Bond ist ein Wertpapier über eine Forderung mit festem Zinssatz. Rowe Price Short-Term Bond Fund PRWBX and Lord Abbett Short Duration Income Fund Class A LALDX there are a growing number of exchange-traded funds ETFs that focus on the sector. Payment for the Bonds will be through electronic funds transfer cheque demand draft.

Its a big liquid fund that yields 24 like AGG and gradually grinds. The calculation of the costs of equity is based on the yield expected on long-term risk-free federal bonds. Alle Infos zum BMO SHORT FEDERAL BOND INDEX ETF ISIN CA0969111024.

You can invest as little as Rs. Siehe Anleihe In der sozialistischen Wirtschaftslehre. Though the tenor of the bond is 8 years early encashmentredemption of the bond.

The BMO Long Federal Bond Index ETF TSXZFL is an active exchange-traded fund that follows the returns of the FTSE TMX Canada Long Term Federal Bond Index by investing in assets with maturities. This investment avenue is popular because of its cost-efficiency risk-diversification professional management and sound regulation. Income from bonds issued by state city and local governments municipal bonds or munis is generally free from federal taxes You will however have to report this income when filing your taxes.

The extent to which a fed funds rate hike impacts a bond portfolio depends on the portfolios duration and its place along the yield curve. Das deutsche Wort ist Anleihe. 1000 per month in a mutual fund.

The discounting is undertaken on the basis of average equity and debt capital costs WaCC Weighted average Cost of Capital. Aktueller Fondskurs Charts Nachrichten Realtime WKN. JPMorgan Funds-EU Government Bond Fund - A EUR DIS Fond.

When included in a well-balanced portfolio bond funds can help balance the risks associated with stock funds. These funds which invest in government bonds are routinely adjusted for inflation. Bond funds are mutual funds or exchange-trade funds ETFs that invest in a portfolio bonds.

However keep in mind that. A mutual fund allows a group of people to pool their money together and have it professionally managed in keeping with a predetermined investment objective. The income from these bond funds is typically exempt from federal taxes and if issued within your state the interest will also be free of state income taxes.

Bond funds can also help you keep pace with inflation through inflation-protected bond funds. Municipal bond income is also usually free from state tax in the state where the bond was issued. The costs of debt capital are based on the financing costs of the ten-year bond issued by hornbaCh-baumarkt-aG during the 2004 2005.

Most bond funds are comprised of a certain type of bond such as corporate or government and further.

Investors Can T Get Enough Bond Funds Marketwatch

Investors Can T Get Enough Bond Funds Marketwatch

Bonds Started To Falter Then The Fed Came To The Rescue The New York Times

Bonds Started To Falter Then The Fed Came To The Rescue The New York Times

8 Best Short Term Bond Funds Bonds Us News

8 Best Short Term Bond Funds Bonds Us News

United States Treasury Security Wikipedia

United States Treasury Security Wikipedia

Outlook For Bond Etfs 2020 And Beyond Seeking Alpha

Outlook For Bond Etfs 2020 And Beyond Seeking Alpha

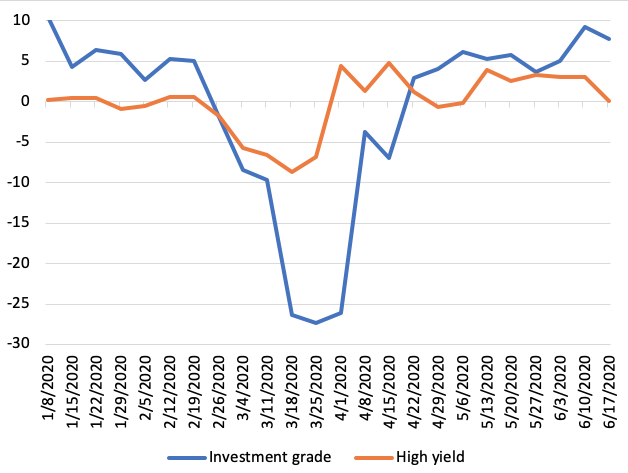

Redemption Risk Of Bond Mutual Funds And Dealer Positioning Liberty Street Economics

Redemption Risk Of Bond Mutual Funds And Dealer Positioning Liberty Street Economics

/treasurynotes-bills-and-bonds-3305609-finalv42-fc941b4ff55d4247951067ef742a406b.png) Treasury Bills Notes And Bonds Definition How To Buy

Treasury Bills Notes And Bonds Definition How To Buy

United States Treasury Security Wikipedia

United States Treasury Security Wikipedia

The Federal Reserve Needs The Power To Buy Corporate Bonds Vox Cepr Policy Portal

The Federal Reserve Needs The Power To Buy Corporate Bonds Vox Cepr Policy Portal

Coronavirus Crash Should You Buy Bonds Right Now The Motley Fool

Coronavirus Crash Should You Buy Bonds Right Now The Motley Fool

Should You Invest In Bonds The Financial Gym

The Spread The Difference Between Moody S Aaa Corporate Bond Yield And Download Scientific Diagram

The Spread The Difference Between Moody S Aaa Corporate Bond Yield And Download Scientific Diagram

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.