How To Dodge Tax. In Tax Havens How Globalization Really Works the authors explain that tax havens are designed to sever an individual from taxable events by placing them in separate countries with different rules.

10 Ways The Rich Avoid Taxes Visual Capitalist

10 Ways The Rich Avoid Taxes Visual Capitalist

It means that when the managers tax bill comes due he owes the federal government 20 percent in taxes the current tax rate on long-term capital gains rather than the 396 percent rate that applies to ordinary income.

/tax-avoidance-vs-evasion-397671-v3-5b71dfc846e0fb0025e54177.png)

How to dodge tax. Freeports achieve the same effect separating the owner of an artwork from the tax. The general broad rule with UK tax is if you have a company incorporated in the UK the tax code in the UK says that company by default will automatically be subject to UK corporation tax which is 19 In Cyprus corporation tax is 125. Panorama Undercover How To Dodge Tax Part 1 of 2.

Maybe the least surprising method that corporations dodge taxes. Where and how to dodge taxes and shift money abroad using trade misinvoicing. A beginners guide Working Paper No12018 ESCAP.

Another way is through the sin of omission. Dodge tax with your spouse If your spouse or same-sex Civil Partner doesnt work or is on a low income you can use them to reduce your tax bill or vice versa. Dodge this death tax.

Exchange traded funds unique structure largely shields them from capital gains taxes on annual distributions. How To Dodge Tax. The humble ISA is.

According to unbiasedcouk the biggest tax wastage comes from households not claiming tax. It turns out that first-time buyers land transfer tax rebate provides an effective loophole for buyers willing to omit certain facts. 6 years ago 2 views.

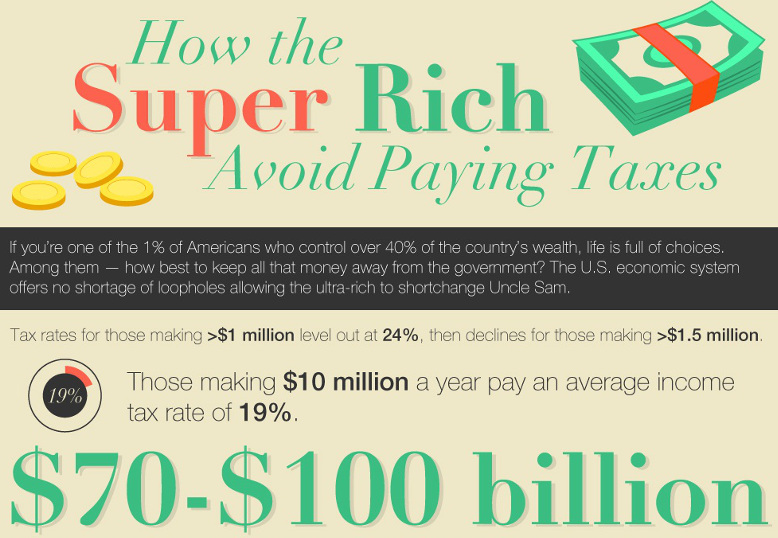

State tax rates by bins of disposable cash income plus individual income taxes federal plus state minus food stamps as groceries are generally exempt and scale the implied amount of sales taxes paid to match 70 times the total amount of indirect taxes recorded in the NIPA for all levels. In all provinces except Alberta and Saskatchewan property buyers must pay a Land Transfer Tax or LTT. Those policies dramatically reduced taxes but unfortunately just for one group of Americans - the rich.

A beginners guide Working Paper No12018 Working paper. Ten legal ways to dodge tax 1. After tax credits the second-highest tax wastage is paying unnecessary Inheritance Tax IHT.

Research very broadly defined. An illegal method used to reduce the amount of tax that a person or company has to pay. A tax on the profits from a sale of non-inventory assets originally purchased for a lesser amount such as stocks bonds property or.

Browse more videos. But theres a legal way to delay if not dodge the tax hit. This dodge halves his effective tax rate on these earnings.

Where and how to dodge taxes and shift money abroad using trade misinvoicing. According to CTJ there are tax breaks introduced through the years for instance by congressmen looking out for local industries for. The use of legal entities and trusts is one way to dodge taxes.

One cunning way of dodging capital gains tax is by borrowing from an investment bank with the shares as collateral after purchasing options which set their price at a fixed rate. Panorama Undercover How To Dodge Tax Part 1 of 2 - YouTube. Ronald Reagans 1980 tax revolt was intended to free Americans from burdensome taxation.

For example by transferring assets to a lower-earning spouse you can reduce your liability to Capital Gains Tax CGT at 18 or 28. Freeports operate as tax havens severing the asset from an individual for tax purposes. Play Dodgeball with It Capital gains tax.

The author tells a fascinating story of how the most anticipated tax reform movement in recent history transferred a big tax burden on to middle and lower class Americans. ICIJ collaborated with the BBC and the Guardian to unmask the nominee directors who pose as public faces for more than 21500 offshore companies. Taking advantage of the plethora of tax breaks that exist in the US.

Tax filing season kicked off this month so it is too late now to better this years return but there is a way to make next years filing that much sweeter while also taking care of your.