At that yield per the rule of 72 it would take you up to 7200 years to double your money. Money market funds may offer you access to your funds through drafts checks debit cards online funds transfer or other methods.

Vanguard Federal Money Market Fund Vmfxx Question Bogleheads Org

Vanguard Federal Money Market Fund Vmfxx Question Bogleheads Org

VUSXX invests mostly in US.

Vanguard federal money market fund interest rate. View mutual fund news mutual fund market and mutual fund interest rates. This security is currently yielding about 025. Investors who arent satisfied with this could choose a short-term bond fund like VBISX the Vanguard Short-Term Bond Index Fund.

Money recently added to your account by check or electronic bank transfer may. As of September 30 roughly 15 of the funds assets were. They are offering current yields of 001 to 009.

Your money market settlement fund is used to pay for and receive proceeds from brokerage transactions including Vanguard ETFs in your Vanguard Brokerage Account. The weighted average maturity of the funds securities was 57 days and their average weighted life was 105 days. Price as of 05172021.

The Federal Reserve set the target range for federal funds at 000 to 025. If you peruse the lists of funds available at large mutual fund companies such as Fidelity or Vanguard youll quickly discover some rather intriguing investments called money market funds. VMFXX Analysis - Vanguard Federal Money Market Fund - Bloomberg Markets.

VMFXX A complete Vanguard Federal Money Market FundInvestor mutual fund overview by MarketWatch. Vanguard Federal Money Market Funds investment objective is to seek to provide current income while maintaining liquidity and a stable share price of 1. VMMXX A complete Vanguard Cash Reserves Federal Money Market FdInv mutual fund overview by MarketWatch.

Since the net asset value of your shares of a money market fund are typically maintained at a stable rate of 1 per share you usually have neither a gain or loss on your sale of shares. Government securities andor repurchase agreements that are collateralized solely by US. MAY 06 0800 PM EDT.

January 31 2011 December 31 2020 10653 Fund as of 123120 10453 Benchmark as of 123120 Annual returns Spliced US. View mutual fund news mutual fund market and mutual fund interest rates. Learn about Vanguard Federal Money Market Fund.

Vanguard Federal Money Market Fund is the only settlement fund available. So when interest rates rise money market mutual funds like Vanguards Prime Money Market Fund become much more attractive to investors. The fund invests at least 995 of its total assets in cash US.

And thats exactly whats happened. The average return of its peers was 000. This value is calculated out to 4 decimal places.

Money market fund Fund facts Risk level Low High Total net assets Expense ratio as of 122220 Ticker symbol Inception date Fund number 12345 199300 MM 011 VMFXX 071381 0033 Investment objective Vanguard Federal Money Market Fund seeks to provide current income while maintaining liquidity and astable share price of 1. Government Money Market Funds Average Growth of a 10000 investment. Government securities or cash collectively.

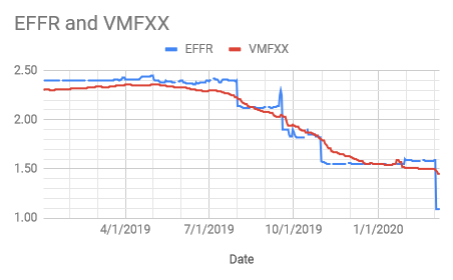

Yields on money market mutual funds tend to follow short-term rates set by the Fed although typically with a lag. The figure is adjusted for open orders to purchase stocks or ETFs at the market or to purchase Vanguard mutual funds or mutual funds from other companies. The net asset value of a money market funds holdings based on the market prices of the funds securities.

Vanguard Federal Money Market Fund. This fund is narrower in focus than the Vanguard Federal Money Market Fund. As with all money market mutual funds the returns are dependent upon.

It includes your money market settlement fund balance pending credits or debits and margin cash available if approved for margin. VMMXX is one of the money market mutual funds that saw its. Vanguard Federal Money Market Fund Investor Shares 214 101 051 Comparative Benchmarks FTSE 3-Month USTreasury Bill Index reflects no deduction for fees or expenses 225 104 055 US.

Benchmark US Govt Money Market Funds. Vanguard Federal Money Market Fund returned 002 for the three months and yielded 005 at quarter-end. That means following a Fed rate cut yields on money market mutual funds trend lower.

Government Money Market Funds. Government Money Market Funds Average 161 064 032 4. Vanguard Cash Sweep Interest Rates VMFXX does have a yield right now of 004.

Vanguard Cash Reserves Federal Money Market Fund seeks to provide current income while maintaining liquidity and astable share price of 1.

/10-year-treasury-note-3305795-Final-b5449ca2619747788f6366ccebd81ca7.png)

:max_bytes(150000):strip_icc()/Clipboard01-f94f4011fb31474abff28b8c773cfe69.jpg)