These indices are based on one of two different internationally recognised sector classification schemes. Sector and industry ETFs Sector risk and reward.

Will Vanguard Step On The Spdr This Technology Etf Just Dethroned The Industry Leader Marketwatch

Will Vanguard Step On The Spdr This Technology Etf Just Dethroned The Industry Leader Marketwatch

The Vanguard sector ETFs track MSCI sector indexes while the SPDR sector ETFs track SP sector indexes.

Sector and industry etfs. Sector ETFs are index-tracking funds. They track sector indices maintained by the index providers. News rankings of top-rated Sector ETFs by category.

If an ETF changes its sector. IShares US Industrials ETF. In the last trailing year the best-performing Sectors ETF was RETL at 115259.

Cost-effective liquid market access. Sector power rankings are rankings between US-listed sector ETFs on certain investment-related metrics including 3-month fund flows 3-month return AUM average ETF expenses and average dividend yields. Historically different industry sectors have exhibited different riskreward characteristics.

Industrial Select Sector SPDR ETF. The Industry Classification Benchmark ICB and The Global Industry Classification Standard GICS. The largest Sectors ETF is the Vanguard Information Technology ETF VGT with 4313B in assets.

Fidelity MSCI Industrials ETF. Investing in sector ETFs can be an efficient way to implement sophisticated strategies with precision and transparency. Concentrating on a sector brings higher risk Sector ETFs exchange-traded funds give you access to a very small part of the overall market such as energy real estate and health care among others.

If an ETFs sector classification changes it will affect the expense ratio calculations. Industry refers to a much more specific group of companies or businesses while the term sector describes a large segment of the economy. Transparency so youll always know the full makeup of your exposure.

The most recent ETF. Use the comprehensive ranking lists to compare funds and find the right investment for you. ETF or ETN Today 1 Mths 1 Yr YTD.

The hot sector strategy. Select Sector SPDR Funds bear a higher level of risk than more broadly diversified funds. Sector ETF products are also subject to sector risk and non-diversified risk which will result in greater price fluctuations than the overall market.

Volume on the horizontal axis with volume in green on up days periods of time and in red on down days periods of time. Here are the best Industrials ETFs. All ETFs are subject to risk including the possible loss of principal.

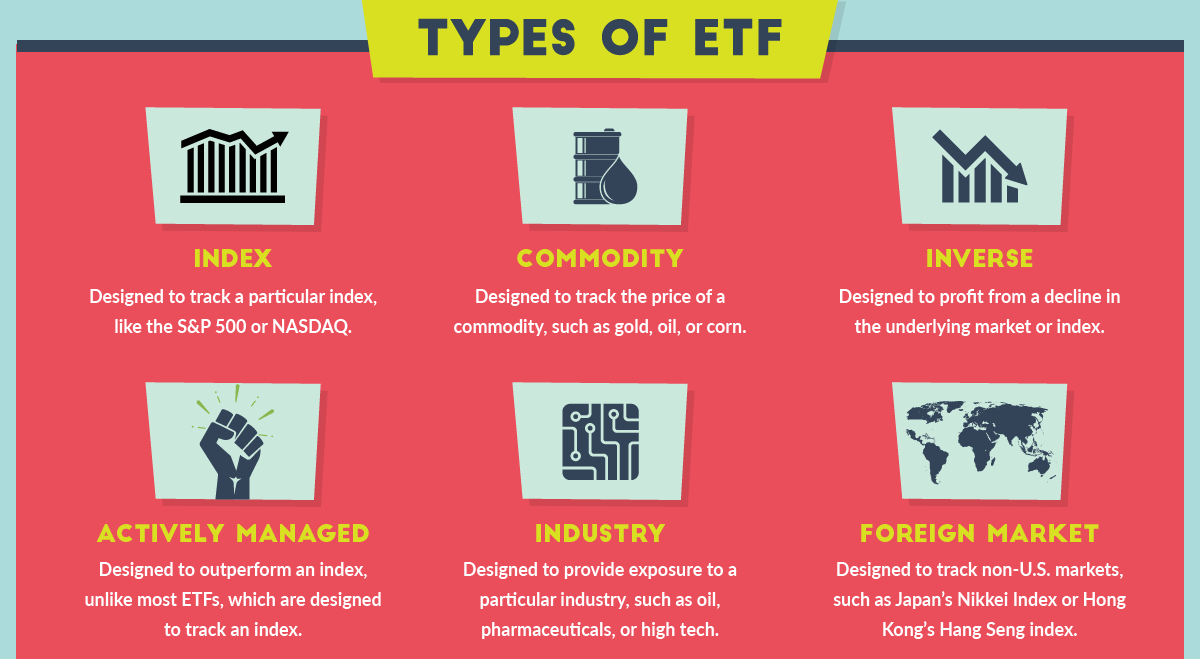

Industry ETFs track specific indexes associated with sectors of industry. Many investors look to sector ETFs as a means to profit from the next hot industry. There are several funds to choose from but one of the best energy sector index funds is Vanguard Energy Index Fund Admiral Shares VENAX and one of the best ETFs is Energy Select Sector SPDR Fund XLE.

What do sector ETFs invest in. Exposure to an entire sector or industry in one trade. The lower the average expense ratio for all US-listed ETFs in a sector the higher the rank.

As you know now well by now from reading this article when investing in sectors it is wise to use an index fund or ETF to gain broad exposure to the various industries within the sector. Vanguard sector ETFs Focus on a specific industry or sector of the market. Sector ETFs products are also subject to sector risk and nondiversification risk which generally results.

The charts are standard price and volume charts. Unlike mutual funds ETFs trade at market prices like publicly traded stocks. Invesco SP 500 Equal Wt Indls ETF.

They provide a way to invest in an entire industry with one product. The total number of holdings in the. Associated fees mean their returns.