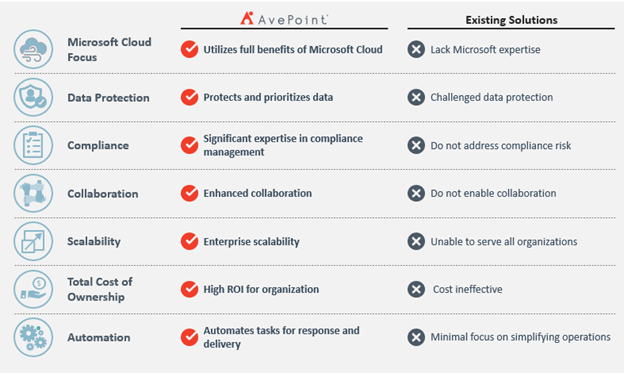

They had hoped to complete the deal by the end of Mar. AvePoint or the Company the largest data management solutions provider for the Microsoft cloud announced today that it has entered into a definitive business combination agreement with Apex Technology Acquisition Corporation NASDAQ.

Apex Avepoint Merger Date Apex Technology Acquisition Corporation

Apex Avepoint Merger Date Apex Technology Acquisition Corporation

About Press Copyright Contact us Creators Advertise Developers Terms Privacy.

Avepoint merger date. Forward-looking statements speak only as of the date they are made. The Largest Microsoft 365 Data Management Solutions Provider Announces 2bn Merger. Merger date leaked avepoint apxt merger webull link 100 portfolio series - get free stocks - deposit 10.

APXT and AvePoint merger date The merger between APXT and AvePoint will likely take place sometime early in 2021 although an exact date hasnt been announced. So much so that investors seem to be ignoring a lot of the potentially. 2021 but like many other SPAC mergers such as the SoFi-IPOE deal its.

AvePoint or the Company the largest data management solutions provider for the Microsoft cloud announced today that it. 23112020 - AvePoint Inc. After the merger between Apex and.

After the merger between Apex and AvePoint is official the newly formed company will trade on the Nasdaq under the new ticker symbol AVPT. Despite SPAC Setbacks Apexs AvePoint Merger Is Still a Winner Dont throw out APXT stock amid the SPAC wreckage By Ian Bezek InvestorPlace Contributor May 4 2021 448 pm EDT The special. Reported preliminary first quarter 2021 results on April 14.

The merger is subject to approval from APXT and AvePoints shareholders and other. This is the first official news on the merger to come out since. Avepoint has recruited the Most Valuable Professional MVP.

AvePoint and Apex announced their merger agreement on Nov. There has been a lot of cold water splashed on the hot SPAC special-purpose acquisition company market. The largest data management solutions provider for Microsoft 365 is set to merge with special purpose acquisition company.

APXT and AvePoint merger date The merger between APXT and AvePoint will likely take place sometime early in 2021 although an exact date hasnt been announced. APXT a publicly traded special purpose acquisition company Apex. The Style of video is similar to Chris Sain and JT Wealth in parts.

APXT Apex and AvePoint the largest data management solutions provider for Microsoft 365 today announced preliminary selected unaudited. APXT a SPAC special purpose acquisition company announced a reverse merger with AvePoint on Nov. Article continues below advertisement APXT-AvePoint merger date isnt final but its imminent.

Apex Technology Acquisition Corporation NASDAQ. Apex Technology Acquisition Corp NASDAQ. In this video I am talking about APXT merger date with AvePoint.

A large influence on thi. APXT and AvePoint merger date The APXT and AvePoint merger will likely close in the first quarter of 2021. APXT and AvePoint havent set a firm date for their merger closure.

23 2020 but still. APXT Avepoint merger date is announced the exact date is not announced yet but the month is. While announcing the merger on.

Avepoint have released some statements on Twitter regarding their upcoming merger with APXT. AvePoint co-founder and current CEO Tianyi TJ Jiang to lead the combined company November 23 2020. AvePoint the Largest Microsoft 365 Data Management Solutions Provider Announces 2bn Merger Transaction includes a fully committed PIPE of 140 mm anchored by top-tier investors.

May 13 2021.