If you are looking for funds with good return ProShares UltraPro Short QQQ fund can be a bad high-risk 1-year investment option. This is generally why these ETFs arent recommended as long term investments but rather as short term trading vehicles.

The Powerful Secret To Tqqq Investing

The Powerful Secret To Tqqq Investing

The ETF has vigorous buying and selling during the day keeping the price youd get for selling close to the price you pay to.

Is tqqq a good investment. Get Our PREMIUM Forecast Now from ONLY 749. Its really an instrument meant to. Meanwhile QQQ shares will.

TQQQ is a levered fund that delivers 3x exposure only over a one-day holding period of NASDAQ-100 stocks. Quite frankly it has become a speculative. Lets take a look at one such ETF the ProShares UltraPro QQQ Nasdaq.

You should give significant consideration to the pros and cons of this ETF prior to investing. TQQQ is exponentially riskier than QQQ and is only suitable for investors with serious risk tolerance. Its fees are lowish o2 but not great as there are plenty that are cheaper.

If you want to own leading Nasdaq companies its tough to beat QQQ. If the market goes sideways the ETFs shares are destined to lose money a reality that is exacerbated by the fact that the portfolio rebalances daily. Leverage in finance is a term used to describe borrowing or the use of debt instruments for financial gain.

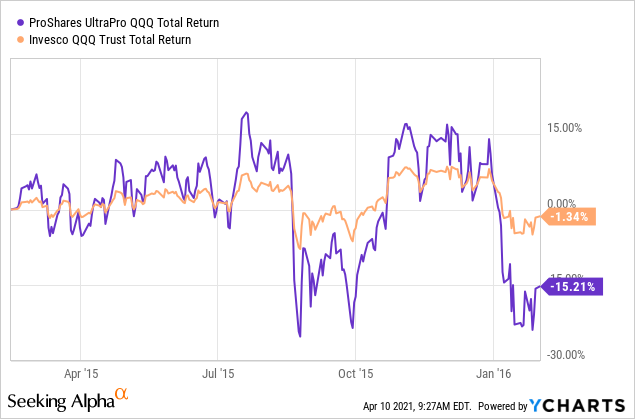

Any leveraged ETF such as TQQQ which seeks to return 3x the daily performance of the NASDAQ-100 a subset of the broader NASDAQ Composite is subject to something called volatility drag. TQQQ is a unique investment security because it uses leverage to enhance the performance of the fund. It also has a dividend yield of only 1.

QQQ has done well over the last few years but I dont think it is a great investment going forward. However if the underlying index stays mostly flat with ups followed by downs the. Many are jumping into TQQQ after seeing the last decade bull run of large cap growth stocks as TQQQ has only been around since 2010 and is up over 5000.

TQQQ which leverages the Nasdaq-100 3-to-1. QQQ which actually. ProShares UltraPro QQQ quote is equal to 90110 USD at 2021-05-14.

Due to their natures QQQ is perhaps best-suited as a long-term investment while TQQQ is built for short-holding periods. With 9B assets under management TQQQ is by far the largest leveraged ETF on the market. The biggest benefit of investing in TQQQ versus other Leveraged ETFs is that fund managers have been fairly successful in achieving stated goals since the product launched.

If you are looking for funds with good return ProShares UltraPro QQQ can be a profitable investment option. It is the ProShares 3X leveraged Nasdaq 100 ETF NASDAQ. TQQQ is one of the largest leveraged ETFs that also tracks the Nasdaq 100.

TQQQ Factset Analytics Insight. The underlying index includes 100 of the largest non. If the Nasdaq-100 moves by 1 TQQQ moves by 3.

3 Investors and traders that do not consider themselves. It doesnt have much diversification within its holdings. TQQQ as is the case with any leveraged ETF is an instrument best used over intraday time frames not as a buy-and-hold investment.

The compounding effect can create greater gains for investors. Emphasis mineand perhaps is wrong 713 views. Is TQQQ a good investment.

TQQQ a 3x leveraged ETF of QQQ NASDAQ-100 provides great reward at great risk. Back tests show that TQQQ can be held longer term 1-Year and beats QQQ but holding for too long 5 Years can. Your investment success on TQQQ critically depends on the momentum in the market.

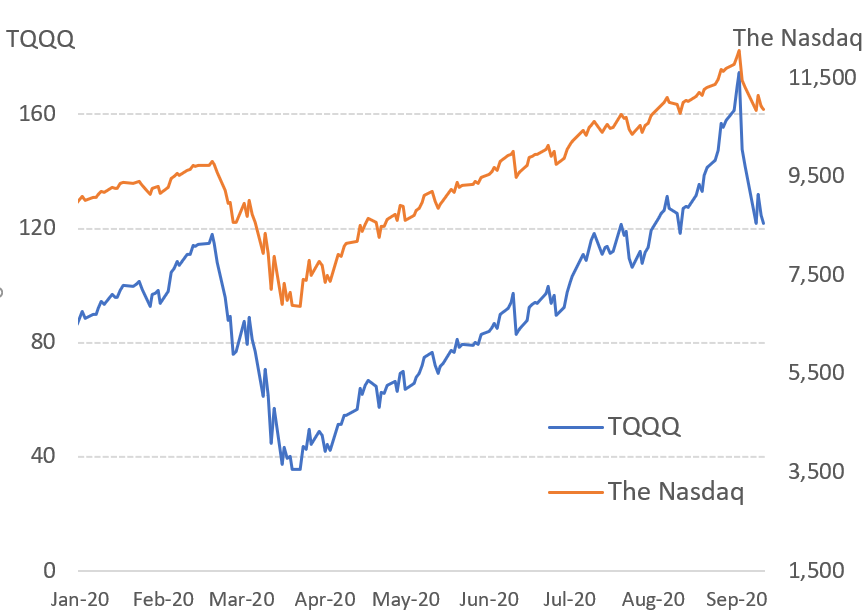

While leveraged funds can produce considerable short-term gains they can also inflict painful. 100 TQQQ Is Not A Good Investment for a Long Term Hold Strategy The graph above illustrates in theory why a 100 TQQQ position is not a good investment for a long term hold strategy. If youre a day trader or consider yourself an active investor then you would be better off trading TQQQ shares.

TQQQ is most beneficial to investors when the market has a clear and sustainable trend. With a roster like that it is not surprising that QQQ is one of the largest equity ETFs and a popular alternative to other broad market funds such as SP 500 -tracking ETFs. Based on our forecasts a long-term increase is expected the TQQQ fund price prognosis for 2026-05-06 is 264058 USD.

ProShares UltraPro Short QQQ quote is equal to 10890 USD at 2021-05-03 but your current investment may be devalued in the future. Because TQQQ tracks its 3x multiplier on a DAILY basis it really isnt sustainable as a long-term buy-and-hold investment. Since inception in 2010 TQQQs market price total return is 4912 percent as compared to the Nasdaq 100s 1897 percent.