Your credit score is calculated based on the information that is found within your various credit reports. As the information in your credit report changes your FICO Score may also change and we provide it monthly so you can.

What Is My Fico Score Homebridge Financial Services

What Is My Fico Score Homebridge Financial Services

A FICO score will be used in making loan and credit card decisions interest rates credit limits loan terms and more.

When do i get my fico score. Also considered are the average age of all your accounts and how long its been since youve used certain accounts. Before you pay for credit monitoring though note that there are several versions of the FICO Auto Score model. Many card issuers provide their cardholders with free access to their credit score.

On the same day his consumer score was about 60 points higher than his FICO score. Obtain your FICO Scores directly from an authorized FICO Score retailer to ensure youre getting your FICO Scores and not any other type of credit score. Each time we provide your FICO Score its based on the information in your TransUnion credit report at that point in time.

Desktop and tablet view. The first place you should check for your free FICO Score is with your credit card issuer. For other types of credit such as personal loans student loans and retail credit youll likely want to know your FICO Score 8 which is the score most widely used by lenders.

A study by the FTC. When they pull your credit report they will be given a FICO score which can be dramatically different from your consumer score. If nothing changes it wont change much or at all.

Length of credit history 15. Eligible Wells Fargo customers on your desktop or tablet sign on to your account and select View Your FICO Credit Score from the Planning and Tools section of your Account Summary. While theres a good.

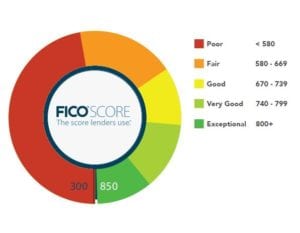

A FICO Score is a three-digit number that lenders use to assess your financial responsibility when deciding whether to work with youYou can think of it like a financial report card but instead. Once you have your credit reports from the three major bureaus its imperative that you check them for accuracy. This combination is what the myFICO score theorists here have determined is what you need for optimal credit building and FICO score.

FICO uses the data found in your individual credit reports provided by the three credit bureaus of Equifax TransUnion and Experian. You can access your score by signing into Citi Online and clicking through to the Card Benefits tab and selecting the FICO Score link. Both your FICO score and credit score are usually updated whenever there is a change.

You can also check your FICO 8 and FICO 9 credit scores through FICO for a fee or you might be able to access your scores for free from your bank or credit card company. If they arent listed they arent delivering FICO Scores. Your lender or insurer may use a different FICO Score than the versions you receive from myFICO or another type of credit score altogether.

How often does your FICO score update. Ultimately what a person needs to improve their FICO scores and build credit are three open credit cards secured or unsecured in good standing and one open installment loan in good standing such as a car home student personal share secured or credit building loan. Youll likely want to know the base FICO Score versions previous to FICO Score 8 as these are the scores used in the majority of mortgage-related credit evaluations.

Where can I get a copy of my credit report. The good news is you can now see your real free FICO score from all three credit bureaus depending on which banks hold your accounts. In the US there are three national credit bureaus Equifax Experian and TransUnion that house credit histories on most of us.

In fact the founder of 7 Steps to a 720 Credit Score Philip Tirone once tested this with his own score. When you pay 3995 a month through FICO you can monitor a handful of your credit reports and scores including your FICO Auto Scores. FICO scores take into account how long youve had your oldest and your newest accounts.

There are several ways to get your FICO Scores both for free and at a cost. You can get a free FICO Score from hundreds of financial services companies including banks credit unions credit card issuers and credit counselors that participate in the FICO Score Open Access program and offer free scores to customers. Monitoring just one doesnt guarantee youll see the same version your lender pulls.

On a smartphone select View your FICO Credit Score at the bottom of your Account Summary. Fortunately there are ways to get your FICO score for free. FICO itself charges 1995 a month for you to see those scores though they also throw in full copies of your credit reports which the free bank scores do not.

When you get your free annual credit report from the three reporting bureaus it typically does not include your FICO score. How to Get Your FICO Score. Most banks and financial institution provide monthly reports on their customers and if anything changes in that month your FICO score is updated.

When you apply for any kind of loan the lender may look at your FICO Scores and credit reports from all three credit bureaus.