We predict that 2020 will be a tale of two halves for muni bonds. Now is an appropriate time to take stock of how the US.

Municipal Bond Market Outlook 2020

Municipal Bond Market Outlook 2020

It primarily invests in the investment grade municipal bonds exempt from federal income taxes and Virginia personal income taxes.

Municipal bond forecast. The municipal bond market ended 2020 on a high note carrying that strength into January. The dire outlook for municipal bonds that was initially forecast when the economy came screeching to a halt in March never fully materialized. May 14 2021 1020 AM ET AFB BAF BBF.

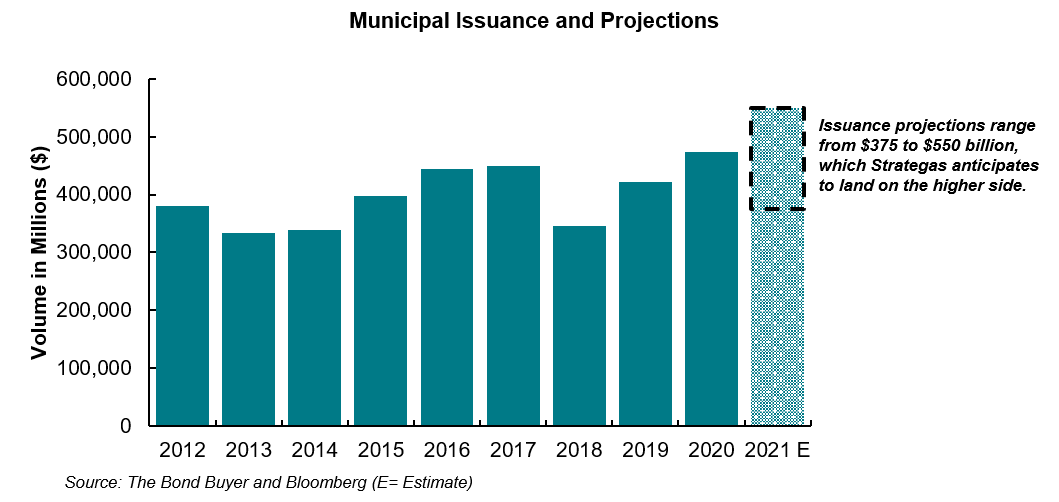

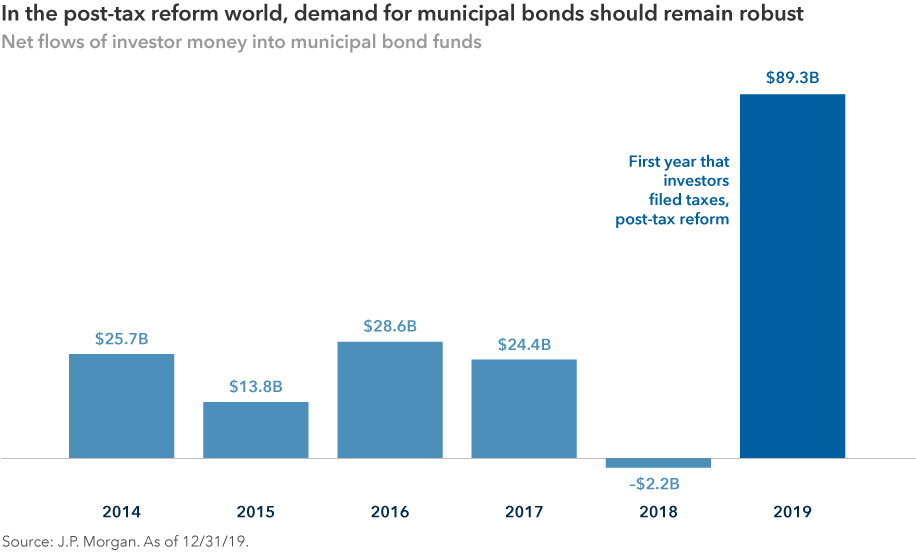

From the start it appeared that 2021 was going to be another strong year for the sector given the. New issue supply was 104 billion with flows of 585 million. In this article we will discuss the 2020 outlook for municipal debt.

2020 was a strong year for municipal bonds with the municipal market showing resilience after a difficult first quarter. In fact there have only been 13 more defaults so far in 2020 than in all of 2019 with the vast majority of the defaults occurring among munis that were initially non-rated or below investment grade to begin with. It pays 48 up to 77 tax advantaged and trades for less than the sum of its safe bond portfolio.

The seasonal trend of light supply and strong demand set the tone for the month with the Bloomberg Barclays Municipal Bond Index a proxy for the market returning 064. Municipal bonds posted strong performance in April with the SP Municipal Bond Index rising 080 for the month bringing year-to-date total return to 054. 1 The 2020 gains were paced for most of the year by strength among higher-rated.

This weeks new issue supply is manageable at 77 billion 16 billion taxable. We read that the municipal bond investors continues to. A Bloomberg report published December 30 noted that the 39 trillion US.

Interest rates rallied lower while the muni market continued to benefit from a favorable. Last year municipal muni bonds experienced the strongest performance in five years. Municipal bond market as represented by the Bloomberg Barclays Municipal Bond Index was poised to finish 2020 with returns of about 52 the seventh straight year of positive performance.

Muni Market Outlook - 2021. Municipal bonds were range bound. The range of approaches is quite wide from ESG aware to a portfolio.

While the economic backdrop remains challenging we believe the US. Brett Owens is chief investment strategist for Contrarian Outlook. Last year the benchmark Bloomberg Barclays US Aggregate Bond Index had a total return of 687 but.

Municipal bonds secured by tobacco settlement revenues which represent 1 of the muni market and 12 of high yield muni bonds posted the strongest performance across muni sectors in 2020 with a stellar 156 return for the year. The MSRB does not review transaction data submitted by submitters for accuracy completeness or any other purpose and does not warrant or. Municipal Bonds for ESG Investors Investors interested in integrating environmental social and governance ESG into a diversified investment portfolio will find that municipal bonds offer a relatively easy path.

We dont expect that 2020 will be a record-breaking year but we think positive returns may be on the horizon nonetheless. It is managed by BlackRock Advisors LLC. Such transaction data andor related information may not exist for all municipal securities and may not be required to be submitted to the MSRB for certain types of municipal securities transactions.

Opinions expressed by Forbes Contributors are their own. Buchbinder also forecasts modest returns for bonds. Blackrock Virginia Municipal Bond Trust is a closed-ended fixed income mutual fund launched by BlackRock Inc.

The fund invests in fixed income markets of United States. In fact there have only been 13 more defaults so far in 2020 than in all of 2019 with the vast majority of the defaults occurring among munis that were initially non-rated or below investment grade to. Emerging markets debt was the best performing fixed income asset.

The tables and charts below provide yield rates for AAA AA and A rated municipal bonds in 10 20 and 30-year maturity ranges. Economy is likely to rebound strongly in 2021 driven by vaccine rollouts and continued fiscal and monetary support. These rates reflect the approximate yield to maturity that an investor can earn in todays tax-free municipal bond market as of 05132021.

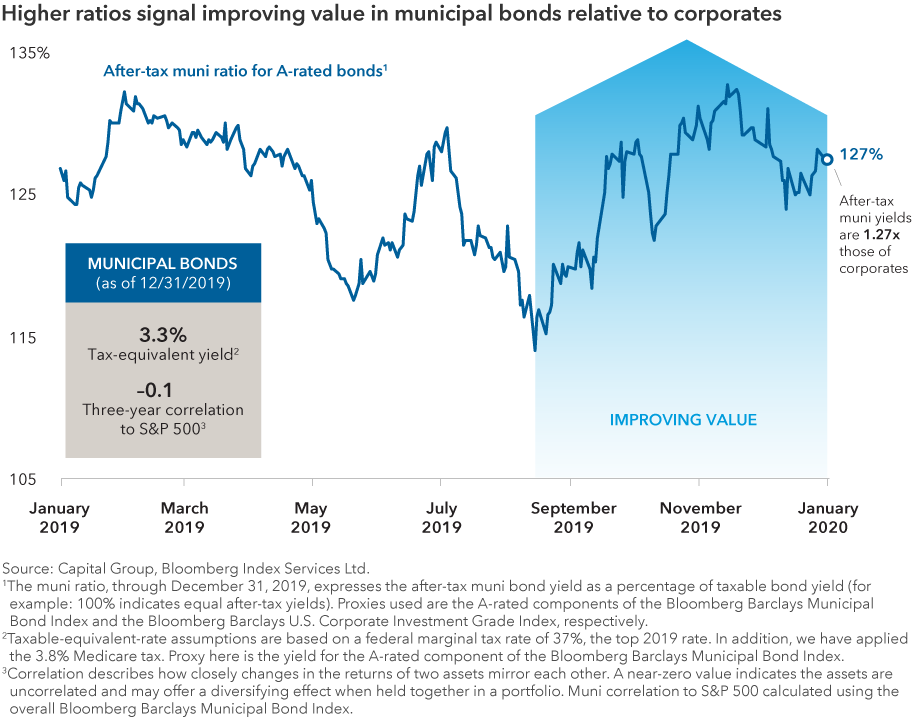

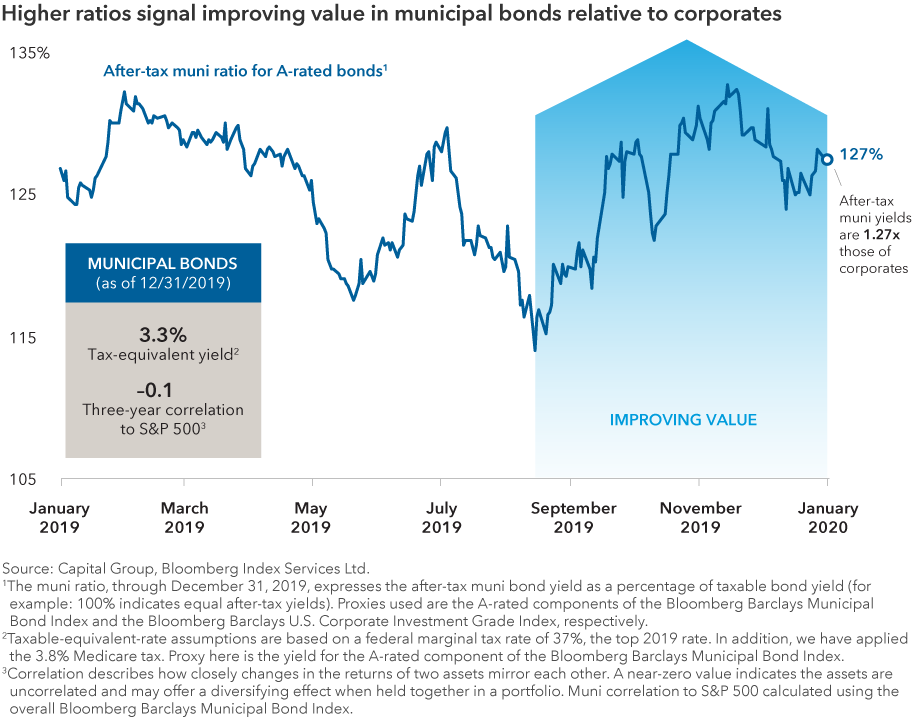

In 2019 municipal debt funds witnessed continued inflow of funds from investors and the issuance of new municipal debt registered 421 billion due to the lower interest rate environment. Municipal Bond Outlook - Hanging Tough. The dire outlook for municipal bonds that was initially forecast when the economy came screeching to a halt in March never fully materialized.

Municipal bond issuers have taken a pervasive revenue hit though a rebound has begun and we do see some attractive value Downgrades look set to increase while defaults should remain rare The pandemic and its economic fallout are reshaping opportunities for active investors.

2021 Muni Bond Outlook Storm Clouds Clearing Charles Schwab

2021 Muni Bond Outlook Storm Clouds Clearing Charles Schwab

Unmasked Potential For Munis In 2021 Blackrock Commentaries Advisor Perspectives

Unmasked Potential For Munis In 2021 Blackrock Commentaries Advisor Perspectives

Municipal Bonds Where We See Value Now Lord Abbett

Municipal Bonds Where We See Value Now Lord Abbett

Baird S 2021 Muni Market Outlook Baird

Baird S 2021 Muni Market Outlook Baird

Muni Bond Market Slowly Reviving From Covid 19 Setback Putnam Investments

Muni Bond Market Slowly Reviving From Covid 19 Setback Putnam Investments

Western Asset Municipal Monthly Update Legg Mason

Western Asset Municipal Monthly Update Legg Mason

Municipal Bond Outlook Tailwinds Still Blowing Just Not As Strong Capital Group

Municipal Bond Outlook Tailwinds Still Blowing Just Not As Strong Capital Group

Municipal Bond Outlook Recovering At Different Speeds Pimco Commentaries Advisor Perspectives

Municipal Bond Outlook Recovering At Different Speeds Pimco Commentaries Advisor Perspectives

Munis In The Year Of Covid Morningstar

Munis In The Year Of Covid Morningstar

2021 Municipal Outlook Reasons For Optimism Context Ab

2021 Municipal Outlook Reasons For Optimism Context Ab

Municipal Bond Outlook Tailwinds Still Blowing Just Not As Strong Capital Group

Municipal Bond Outlook Tailwinds Still Blowing Just Not As Strong Capital Group

2021 Muni Bond Outlook Storm Clouds Clearing Charles Schwab

2021 Muni Bond Outlook Storm Clouds Clearing Charles Schwab

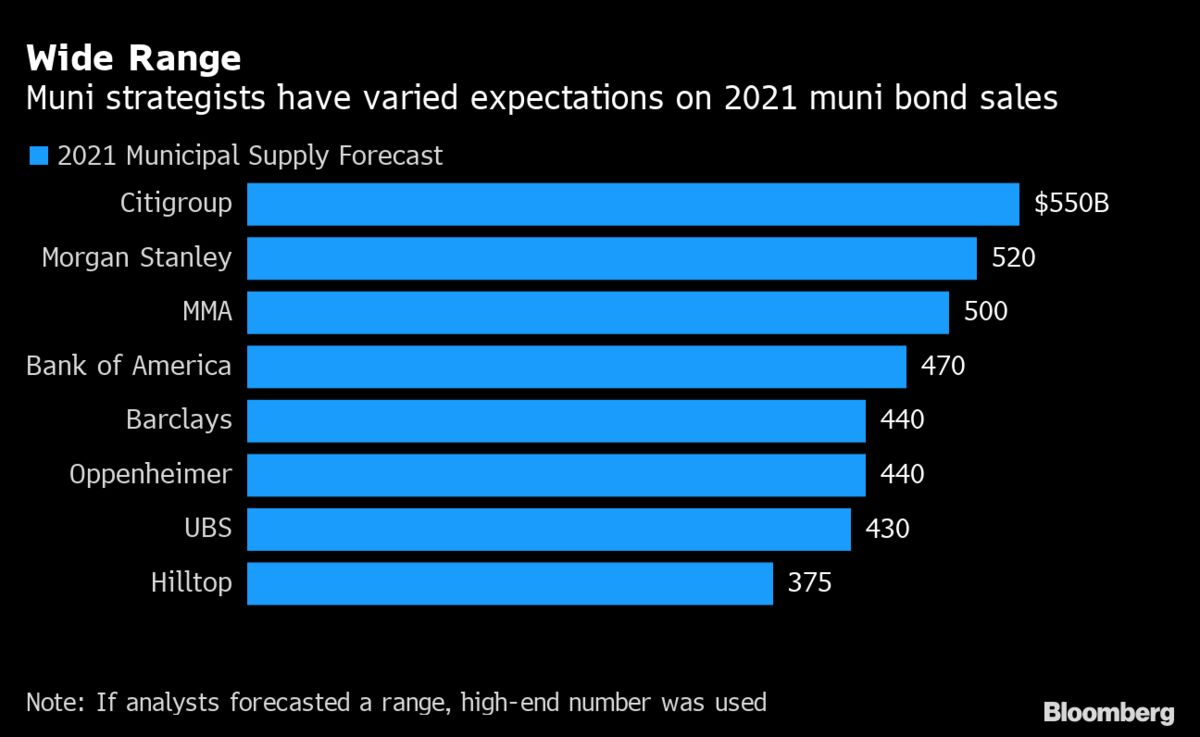

Wall Street Diverges On Muni Sales As Citi Sees 550 Billion Bloomberg

Wall Street Diverges On Muni Sales As Citi Sees 550 Billion Bloomberg

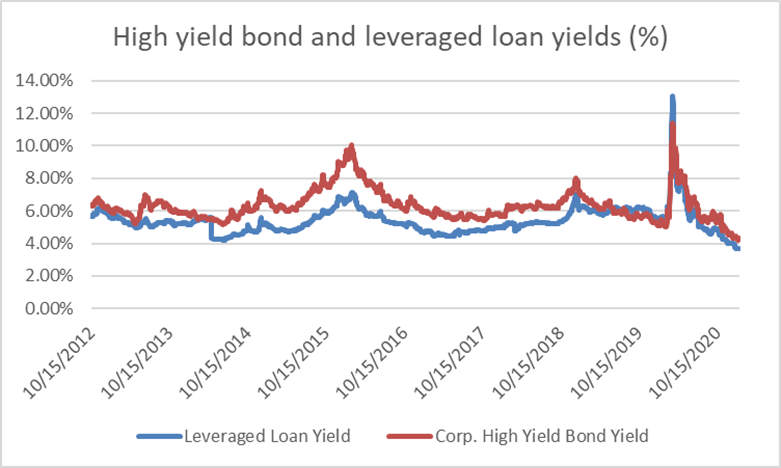

2021 Bond Market Outlook Seeking Alpha

2021 Bond Market Outlook Seeking Alpha

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.