DENVER CBS4 As home values soar in the Denver metro area property tax rates are sure to trend up. For the tax year beginning July 1 2019 owners of real property within Metros jurisdiction pay a total of 48 cents 048 per 1000 of assessed value for three voter-approved bond measures.

Metro Denver Homeowners Face Property Tax Hikes In Next Two Years

Delinquent Property Tax Sale.

Metro property taxes. Assessors from Adams Arapahoe Boulder Broomfield Denver Douglas Elbert. Metros website has a detailed breakdown of how this is calculated as well as a calculator where you can type in all your information and see your estimated property tax. On the county level 12 of the 16 areas with average annual taxes of more than 10000 were in the New York City metro area -- led by Rockland County NY where the charge was 13931.

We provide an independent service that helps Ontario property owners review and reduce their property taxes. There is a 100 processing fee for taxes paid with an E-Check. Austin metro residents facing increased property taxes.

The median property tax in Texas is 227500 per year for a home worth the median value of 12580000. Depending on your households income you may be eligible to receive financial assistance for your delinquent property taxes owed to the Wayne County Treasurers Office. Heres a ranking of property tax rates across the Des Moines metro from highest to lowest.

A charter referendum on the citys property tax rate could send ripple effects across the county. Metros website has a detailed breakdown of how this is calculated as well as a calculator where you can type in all your information and see your estimated property tax. On Thursday April 29 2021 Mayor John Cooper announced at the State of The Metro address the Certified Tax Rate and proposed that it remain as the tax rate.

Metro Property Assessor Vivian Wilhoite claimed that Hunter requested to move the county line to avoid the recent Davidson County tax hike. Keep my Tennessee Home. Texas has one of the highest average property tax rates in the country with only thirteen states levying higher property taxes.

However Hunter submitted the request to move the county line in 2019 long before the Metro NashvilleDavidson County government considered the tax increase as hes already confirmed to reporters. He said his proposed tax rate for the next fiscal year 3288 for every 100 of assessed value would be the third lowest property tax rate in Metro history. Property tax notices are out and a lot of people are surprised by how much valuations have increased.

Metropolitan Property Tax Consultants Legal Services Professional Corporation is Ontarios leading residential property tax appeal group. If the tax rate stays as proposed using your appraisal value recently received you can calculate your tax payments HERE using the proposed tax. Nashvilles Metro Council implemented the 34 property tax increase in June of 2020.

Wayne Metro can help homeowners submit the Poverty Tax Exemption application for current year taxes. Important - There is a 255 processing fee 200 minimum charge for taxes paid with a credit or debit card. Counties in Texas collect an average of 181 of a propertys assesed fair market value as property tax per year.

The voter-approved capital projects funded through property taxes are. Metros property tax rate has rarely been below 4In fact the average combined rate over the past 25 years is 430. Metro Council approves 34 percent property tax increase as part of new budget.

Property taxes in Metro Nashville have been the topic of debate for months. 1661 of 1000 of taxable value. How can Wayne Metro help homeowners with property taxes.

FY 2022 property tax rate.

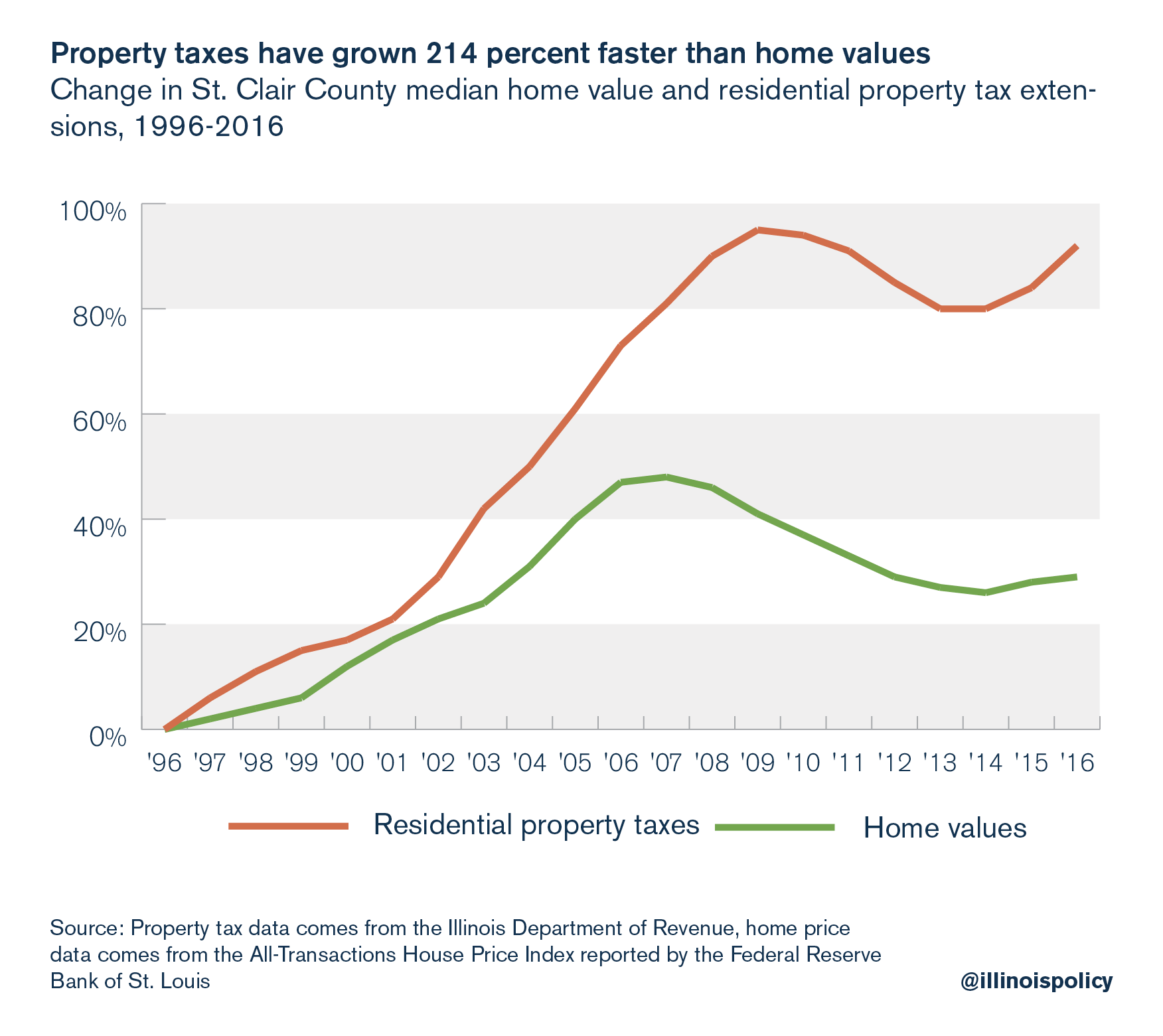

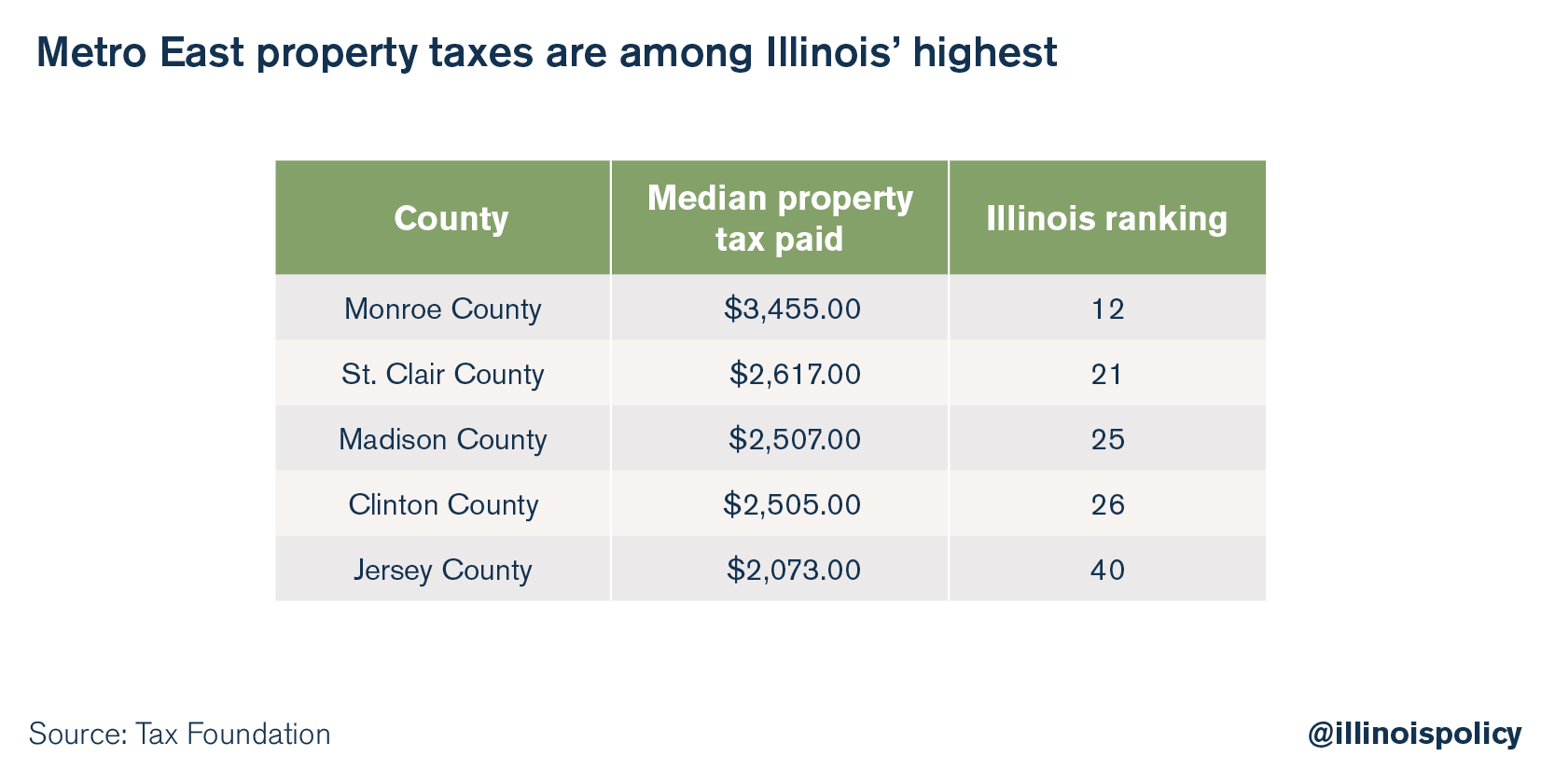

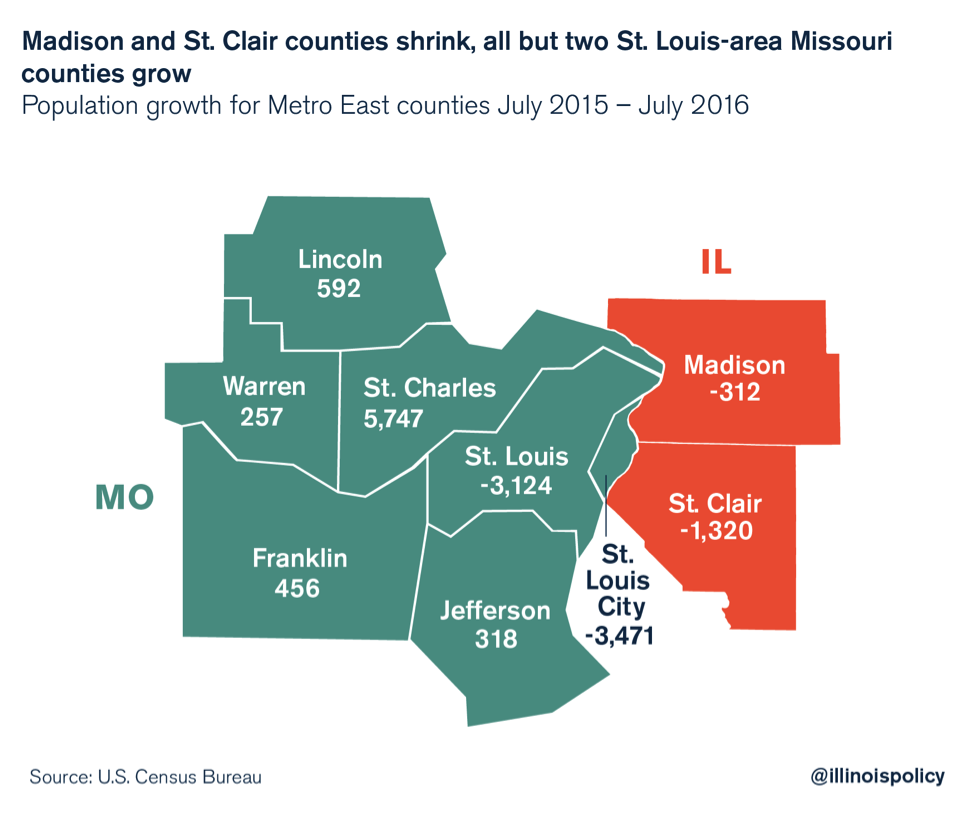

Pension Costs Push Metro East Property Taxes Up As Population Shrinks

Pension Costs Push Metro East Property Taxes Up As Population Shrinks

Highest And Lowest Property Tax Rates In Greater Boston Lamacchia Realty

Highest And Lowest Property Tax Rates In Greater Boston Lamacchia Realty

Property Taxes Which Cities And Towns Give And Which Take In The Twin Cities Region Minnpost

Property Taxes Which Cities And Towns Give And Which Take In The Twin Cities Region Minnpost

What Is A Metro Special Taxing District What Prospective Buyers Need To Know The Sall Team

What Is A Metro Special Taxing District What Prospective Buyers Need To Know The Sall Team

Who Bears The Burden Of Property Taxes In Canada S Largest Metropolitan Areas Fraser Institute

Who Bears The Burden Of Property Taxes In Canada S Largest Metropolitan Areas Fraser Institute

Hefty Property Taxes For Metro Denver Real Estate Market

Hefty Property Taxes For Metro Denver Real Estate Market

Taxation In Castle Pines City Of Castle Pines

Taxation In Castle Pines City Of Castle Pines

Metro Denver Homeowners Face Property Tax Hikes In Next Two Years

Metro East Median Property Taxes Rank In The Top 50 Highest In Illinois

Metro East Median Property Taxes Rank In The Top 50 Highest In Illinois

When Will Your City Feel The Fiscal Impact Of Covid 19

When Will Your City Feel The Fiscal Impact Of Covid 19

Metro East Median Property Taxes Rank In The Top 50 Highest In Illinois

Metro East Median Property Taxes Rank In The Top 50 Highest In Illinois

Real Property Tax In The Philippines Important Faqs Lamudi

Real Property Tax In The Philippines Important Faqs Lamudi

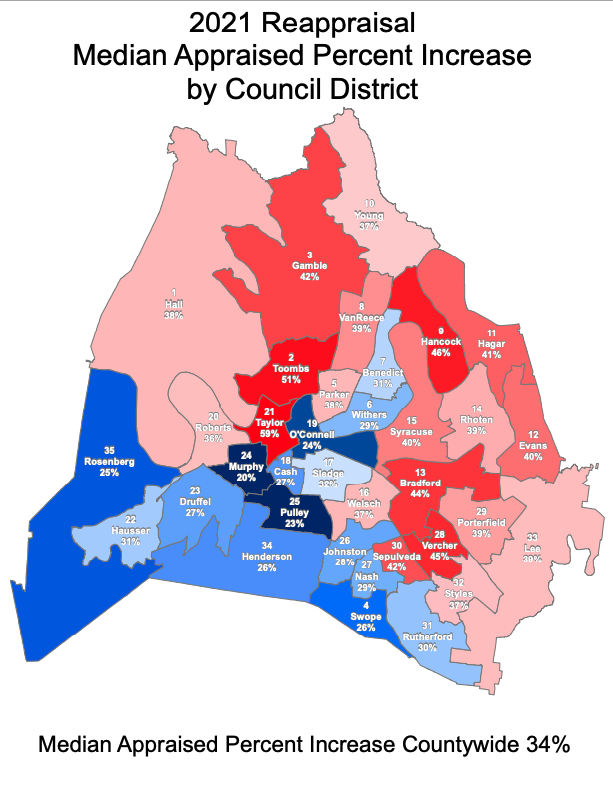

Nashville Property Values Are Up Big In Reappraisal So Some Will See Higher Tax Bills Wpln News Nashville Public Radio

Nashville Property Values Are Up Big In Reappraisal So Some Will See Higher Tax Bills Wpln News Nashville Public Radio

2014 Property Taxes In Metro Vancouver Fraseropolis

2014 Property Taxes In Metro Vancouver Fraseropolis

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.