One could say that this is nothing impressive compared to earning 200-300000 USD in Silicon Valley but if you account for the cost of living and the fact that only the top developers earn more than 200000 USD in SV source - PayScale then its starting to look much better for Switzerland. Benefits received by those individuals to taxation.

Swiss Corporate Tax Overhaul Faces Big Test Wsj

Swiss Corporate Tax Overhaul Faces Big Test Wsj

71 Zeilen Highest marginal tax rate Corporate rate.

Switzerland tax rate vs us. The maximum rates of tax that may be imposed on dividend and royalty income are generally the same as in the current US. The average for OECD countries was 255. However a range of allowances and deductions means youll usually pay much less.

Whether or not you pay capital gains tax on trading profits depends on whether the tax office categorizes you as a private investor or as a professional investor. In Switzerland income taxes are levied on federal cantonal and municipal levels. The tax rate applicable to a married couple or individuals in a Swiss registered partnership is the rate applicable to 50 of their combined income so-called splitting.

Citizens residing in Switzerland to taxation. In 2021 the federal income tax varied from a bracket of 077 for single taxpayers and 1 for married taxpayers to the maximum rate of 115. Thanks everyone for your help.

89 more than Switzerland Highest marginal tax rate Individual On income exceeding US 63031200 Ranked 1st. Switzerland as the residence country also subjects the US. In addition and unlike income taxes there is little difference between the single and the married rates.

Private investors do not pay tax on capital gains achieved through investing their assets. If you are moving to a different canton the tax difference is an important issue. In Switzerland an income of 3813693 CHF 3000000 GBP is more than the lowest average advertised salary of 3340000 CHF 2627375 GBP and less than the countrys average income of 9600000 CHF.

The federal Swiss corporate tax rate is a flat rate of 85 but additional cantonal and municipal rates can vary considerably. Switzerland has a bracketed income tax system with ten income tax brackets ranging from a low of 000 for those earning under 13600 to a high of 1320 for those earning more then 166200 a year. However wealthy individuals can pay a.

The marginal tax rate on wealth tops at 03 when you reach CHF 32m in assets. Taxes on capital gains earned when you sell securities at a profit are less straightforward. In 2017 a single Swiss resident without children paid almost 17 of their gross salary in taxes and social security contributions.

0 115 federal 372 canton 0-15 municipal 77 standard rate 38 or 25 reduced rates Taxation in Switzerland Syria. Seems it can be even higher that we have currently in US no double taxation. Figures based upon 1 USD 070921936 GBP.

12 or 6 reduced rate Taxation in Sweden Switzerland. When I go to Credit Suisse calculator it gives me the tax rate around 29. Just like in Switzerland taxes in the United States are levied at both state and federal levels which sees large differences in income tax paid in different parts of the country.

Pursuant to Article 10 dividends from direct investments are subject to tax by the source country at a rate of five percent. Federal income tax rates range between 10 per cent and 40 per cent and depending what state you live in you can pay an additional state income tax ranging from 0 per cent no tax or at the highest end. Protocol Amending the Convention between the United States of America and the Swiss Confederation for the Avoidance of Double Taxation with Respect to Taxes on Income signed at Washington on October 2 1996 signed on September 23 2009 at Washington as corrected by an exchange of notes effected November 16 2010 and a related agreement effected by an.

The OECDs Taxing Wages 2017 report lists the average income tax rate paid by Americans with an income of US 87747 at 237. How does the Switzerland Income Tax compare to the rest of the world. So the amount you pay depends on which canton and even more specifically which municipality you reside in.

22 5 15 NA Taxation in Syria Taiwan. Not very high compared with some other European countries but not exactly low. The tax rate applicable to single widowed divorced or separated individuals living with a dependant child or adult is the rate applicable to 50 of the income.

The United States as the source country subjects up to 85 percent of the benefits paid to US. Contrary to popular opinion Switzerland does not allow foreign individuals to live and bank in its borders tax-free. Broadly speaking wealth taxes in Switzerland are quite low.

For individuals with a taxable income below CHF 14500 and couples with a taxable income below CHF 28300 no federal tax is levied. Foreign tax credit relief can be applied only on the US. Taxation in Taiwan Tajikistan.

To compare taxes in Switzerland the tax calculator at comparisch works out how much direct federal tax municipal tax cantonal tax poll tax and church tax is payable in the municipalities in question. 13 25 non-residents 5 13. Tax system in Switzerland.

The maximum corporate tax rate including all federal cantonal and communal taxes is between 119 and 216.

Is The U S The Highest Taxed Nation In The World Committee For A Responsible Federal Budget

Is The U S The Highest Taxed Nation In The World Committee For A Responsible Federal Budget

How Scandinavian Countries Pay For Their Government Spending

How Scandinavian Countries Pay For Their Government Spending

The U S Corporate Effective Tax Rate Myth And The Fact Tax Foundation

The U S Corporate Effective Tax Rate Myth And The Fact Tax Foundation

Switzerland Will Remain A Low Tax Centre For Big Firms The Economist

Switzerland Will Remain A Low Tax Centre For Big Firms The Economist

Corporate Income Tax Rates In The Oecd Mercatus Center

Corporate Income Tax Rates In The Oecd Mercatus Center

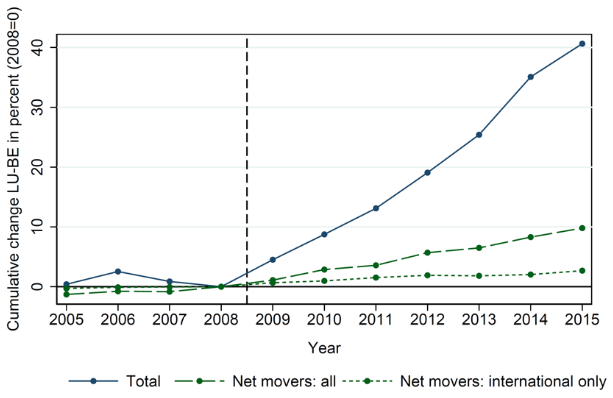

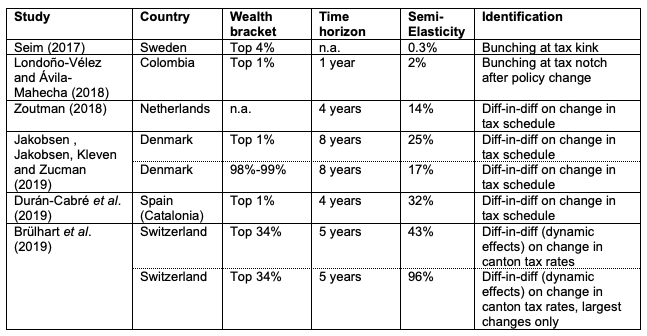

Wealth Taxation The Swiss Experience Vox Cepr Policy Portal

Wealth Taxation The Swiss Experience Vox Cepr Policy Portal

Updated Corporate Income Tax Rates In The Oecd Mercatus Center

Updated Corporate Income Tax Rates In The Oecd Mercatus Center

What Are The Consequences Of The New Us International Tax System Tax Policy Center

What Are The Consequences Of The New Us International Tax System Tax Policy Center

How Low Are U S Taxes Compared To Other Countries The Atlantic

How Low Are U S Taxes Compared To Other Countries The Atlantic

Oecd Corporate Tax Rate Ff 01 04 2021 Tax Policy Center

Oecd Corporate Tax Rate Ff 01 04 2021 Tax Policy Center

Wealth Taxation The Swiss Experience Vox Cepr Policy Portal

Wealth Taxation The Swiss Experience Vox Cepr Policy Portal

How High Are Taxes In Switzerland Quora

How High Are Taxes In Switzerland Quora

Taxation In Switzerland Wikipedia

Taxation In Switzerland Wikipedia

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.