Well only accept cash deposits into your Wells Fargo Consumer checking or savings. If you dont have accounts with Wells Fargo make sure the check is drawn off of Wells Fargo.

How To Find My Wells Fargo Account Number On Wellsfargo Com Without A Statement Quora

How To Find My Wells Fargo Account Number On Wellsfargo Com Without A Statement Quora

Some banks offer free cashiers checks in certain circumstances.

How to cash a wells fargo check without an account. Budgeting cash flow and spending tools. A check-cashing store is a convenient way to get access to your funds but it can also be the most expensive one. There is no limit on the amount of the check cashed.

While many other institutions such as Walmart and Payday Loan Companies charge check cashing services there is a crucial difference between them. Depending on the card youll likely be charged a fee for opening a new prepaid card and each time you deposit a check. Wells Fargo currently charges up to a whopping 750 for a non-customer to cash a check drawn upon their bank calling it a check-cashing service.

But its a good thing you asked because as odd as it sounds many banks dont keep 40000 ready to hand out to people. Drivers licenses and passports are the most common. If you dont need actual cash but just access to some of your checks funds quickly consider transferring the checks funds to a prepaid debit card.

We dont cash money orders that say payable through wells Fargo because those are third party and we cannot verify those funds. A Los Angeles Times analysis conducted in 2017 found that Bank of America JPMorgan Chase and Wells Fargo all charged around 8 per noncustomer check albeit with an important fee waiver for payroll checks. Even some smaller banks are getting in on the practice so it.

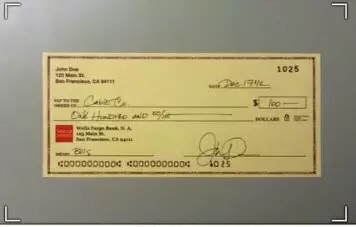

Instead of charging a flat fee for cashing a check though many of them charge a percentage of the check which can range from 1 to 4. For example you can get a Wells Fargo cashiers check for a 10 fee but you must pay an additional 8 delivery charge if you order the cashiers check online. A current government issued-ID with a photo.

Good for Wells Fargo Home Mortgage customers. Times only Citibank didnt charge noncustomers check-cashing fees. Even if you have a bank account you may need access to this cash immediately.

15 monthly service fee how to avoid the fee. There is a chance the check could be returned unpaid if the maker does not have enough money to cover the check. The charge for doing so is 750.

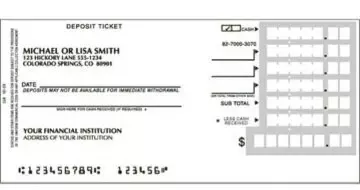

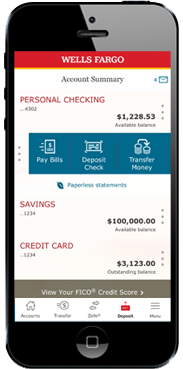

When you deposit a paper check Wells Fargo must forward it to the bank on which it was written. Most national and regional bank chains such as Wells Fargo and Bank of America allow for mobile check depositing through their apps. Wells Fargo Check Cashing Fees.

To cash a check at Wells Fargo Bank or most other retail banks in the USA as a non-customer you will need. No-fee cashiers checks and money orders. The first form can be a drivers license state ID military ID or a passport.

You only need a smartphone with a functioning camera. Here are the ways you cash a check from cheapest to most expensive. Cashing your check with PayPal can be the easiest option as you can cash it from home.

When you deposit a check it can take a couple of days before the funds are available depending on who the type of check and who issued it. Current means not expired. As stated in the article you can indeed cash a check at Wells Fargo without an account.

Wells Fargos No-Cash-Deposits Policy According to Wells Fargo. When you cash a check you get the cash immediately. These stores may also provide other services including payday loans title loans and more.

We need two forms of ID. To cash a Wells Fargo payroll check you can take it to your own bank visit a Wells Fargo bank go to customer service at a store like Walmart or Kmart or visit another location that can conduct a Wells Fargo check verification and issue cash in exchange for a small fee. Wells Fargo charges a flat rate of 750 per check cashed.

Of the major banks investigated by the LA. No check from an outside bank can be cashed at Wells Fargo if you are a non-account holder. If you cant make it into a bank branch you may be able to have a cashiers check sent to you.

Monthly service fee waived with a linked Wells Fargo Home Mortgage. Another way to cash a check if you dont have a bank account is to sign the check over to someone you trust who does have a bank account and have that person cash the check at their bank. 10 discount on personal style checks.

Postage or delivery fees might then apply.

Mobile Banking Online And Mobile Overview Wells Fargo

Mobile Banking Online And Mobile Overview Wells Fargo

Make Mobile Deposits Wells Fargo

Make Mobile Deposits Wells Fargo

How To Transfer Money To A Wells Fargo Account Quora

How To Transfer Money To A Wells Fargo Account Quora

Wells Fargo Check Cashing Policy Account Holders Non Customers First Quarter Finance

Wells Fargo Check Cashing Policy Account Holders Non Customers First Quarter Finance

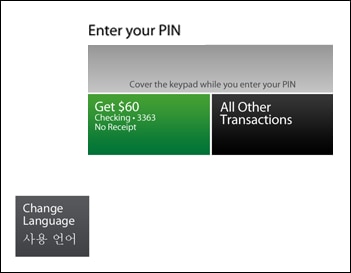

Wells Fargo Atm Features Wells Fargo

Wells Fargo Atm Features Wells Fargo

Account Summary And Activity Wells Fargo Business Online Overview

Account Summary And Activity Wells Fargo Business Online Overview

How To Find My Wells Fargo Account Number Online Quora

Summer 67 When Checks Became Almost Too Pretty To Cash

Summer 67 When Checks Became Almost Too Pretty To Cash

Summer 67 When Checks Became Almost Too Pretty To Cash

Summer 67 When Checks Became Almost Too Pretty To Cash

How To Cash A Check Without A Bank Account Mybanktracker

How To Cash A Check Without A Bank Account Mybanktracker

Mobile Deposit Remote Deposit Deposit By Phone Wells Fargo

Mobile Deposit Remote Deposit Deposit By Phone Wells Fargo

Wells Fargo Extends Hours Via Atm Deposit Capture Finovate

How To Find My Wells Fargo Account Number On Wellsfargo Com Without A Statement Quora

How To Find My Wells Fargo Account Number On Wellsfargo Com Without A Statement Quora

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.