The following trading strategy will keep you on the dominant side of the crude oil market and provide you with a little-known and seldom-used options volatility model that serves as a reliable trading filter. Crude oil is one of the favorite markets of futures day traders.

Crude Oil Futures How To Trade In Crude Oil Futures The Economic Times

Crude Oil Futures How To Trade In Crude Oil Futures The Economic Times

The market typically reacts well to pivot points and support and resistance levels.

How to trade crude oil futures. Learn What Moves Crude Oil. You also need a large bankroll to get started. Crude oil moves through perceptions of supply and demand affected by worldwide output as.

Anzeige Trade Oil CFDs With Our Software. 19 th or 20 th of every month. Per barrel Lot size.

You have to make sure to use stops in this market as it can make very swift moves at any given time. When day trading crude oil futures contracts use the OVX or Oil Volatility Index as a directional proxy. Oil futures are an agreement to buy or sell an exact amount of oil for a set price at a set date in the future.

These types of futures are favourite among many investors because margins as well as lot sizes are small. Anzeige Trade Oil CFDs With Our Software. Professional traders and hedgers dominate the energy futures markets with industry players.

Crude oil futures are standardized contracts that trade on commodity exchanges and their values reflect the anticipated price of crude oil in the future. 72 of retail lose money. 5 Steps to Making a Profit in Crude Oil Trading 1.

This type of contract trading is commonly seen within the commodities market due to the volatility of oil pricing. 72 of retail lose money. Learn How to Day Trade Crude Oil Futures in Our Crude Oil Trading Room with Veteran Trader Rob Mitchell.

That is why to become fully prepared and educated to trade crude oil futures successfully you should firstly start from understanding the basics of the commodity. 3000 crore of crude oil futures trading takes place in the MCX every day. Or dont and lose your money.

You can participate in the crude oil market in several ways. How to trade crude oil futures in India. That way you will be able to explain the key drivers of the price and make better predictions and more accurate analysis.

Crude oil is ranked among the most liquid commodities in the world meaning high volumes and clear charts for oil trading. Oil traders should understand how. If you want to trade in these futures in India you will have to do it on the Multi Commodity Exchange or MCX.

Perhaps the most popular method of crude oil trading is through futures contracts also known as forwards. It is the most actively traded commodity on the exchanges. Crude oil contracts on the MCX.

A crude oil futures contract is an agreement to make or take delivery of a specified quantity of crude oil on a specified future date at a predetermined price. To trade in oil futures you need two characteristics that are often disparate. 100 barrels Expiry.

Here two parties enter into an agreement known as a futures contract to buy or sell a specific quantity of crude oil at a predetermined future date at a pre-decided price. Oil futures contracts arent measured in. Two types of crude oil contracts are traded on the MCX.

Crude oil Main Price quote.

How To Trade Oil Crude Oil Trading Strategies Tips

How To Trade Oil Crude Oil Trading Strategies Tips

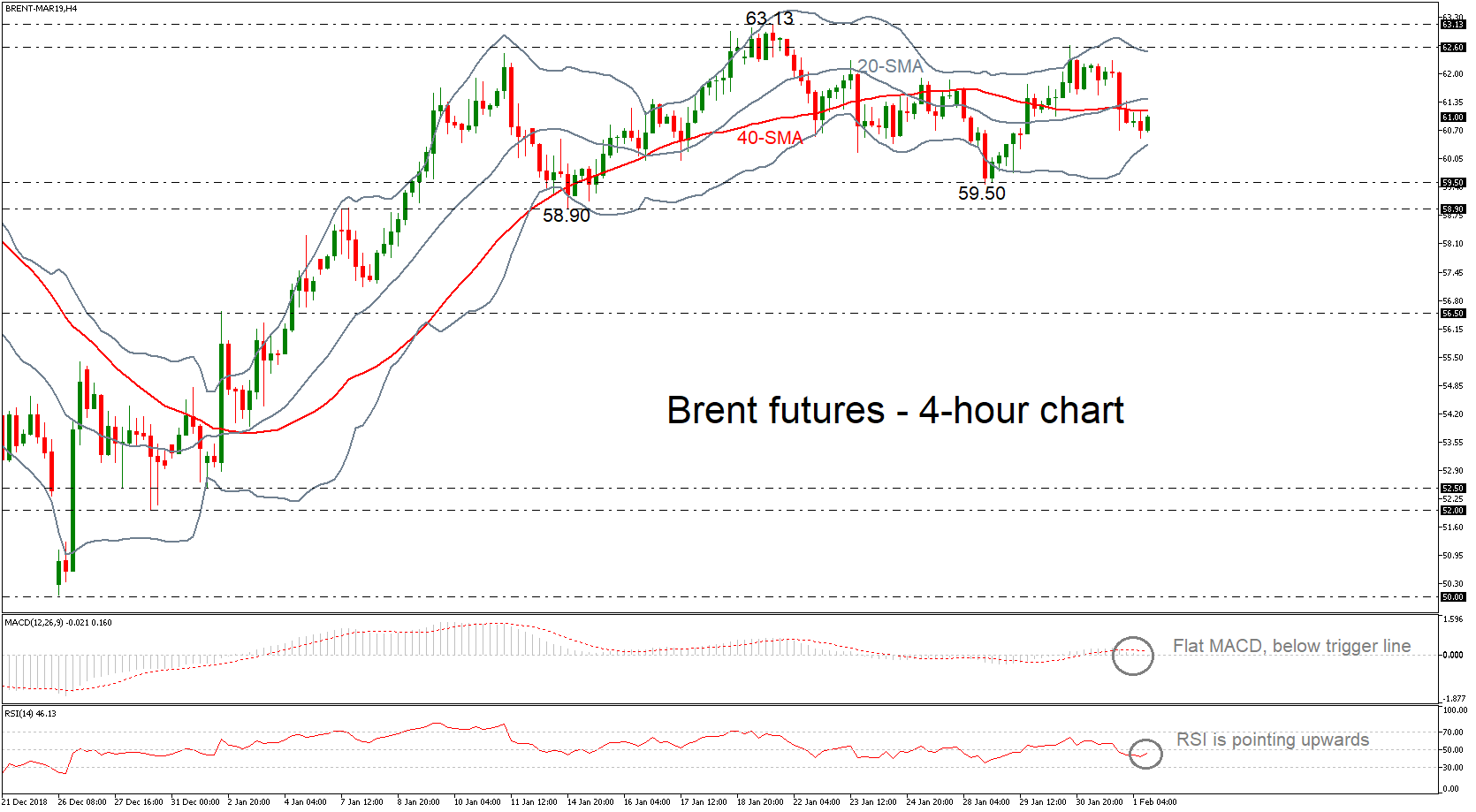

Technical Analysis Brent Crude Oil Futures Trade Sideways In Near Term Hold In Tight Bollinger Band

Technical Analysis Brent Crude Oil Futures Trade Sideways In Near Term Hold In Tight Bollinger Band

/dotdash_Final_5_Steps_to_Making_a_Profit_in_Crude_Oil_Trading_Aug_2020-01-58f79ee3d9fd4ee384ef25284ad48aca.jpg) 5 Steps To Making A Profit In Crude Oil Trading

5 Steps To Making A Profit In Crude Oil Trading

Technical Trading Signals For Wti Crude Oil Futures Contract 2007 2008 Download Scientific Diagram

Technical Trading Signals For Wti Crude Oil Futures Contract 2007 2008 Download Scientific Diagram

Trading Crude Oil Futures The One Minute Trade Youtube

Trading Crude Oil Futures The One Minute Trade Youtube

How To Trade Like A Professional Oil Trader Crude Oil Trading Tips

How To Trade Like A Professional Oil Trader Crude Oil Trading Tips

Day Trading Crude Oil Futures Cannon Trading

Day Trading Crude Oil Futures Cannon Trading

October 10 Breakout Trade In Crude Oil Futures Daniels Trading

October 10 Breakout Trade In Crude Oil Futures Daniels Trading

Crude Oil Trading Strategy Weekly Inventory Report Tradepro Academy

China Launches Crude Oil Futures Trading

China Launches Crude Oil Futures Trading

/GettyImages-627470629-578d255f5f9b584d200395b8.jpg) The Basics Of Trading Crude Oil Futures

The Basics Of Trading Crude Oil Futures

How To Trade Like A Professional Oil Trader Crude Oil Trading Tips

How To Trade Like A Professional Oil Trader Crude Oil Trading Tips

Day Trading Crude Oil Futures Cannon Trading

Day Trading Crude Oil Futures Cannon Trading

Technical Analysis Wti Crude Oil Futures Trade Around 2 Month High Strongly Bullish In Long Term

Technical Analysis Wti Crude Oil Futures Trade Around 2 Month High Strongly Bullish In Long Term

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.