The more allowances you claim the less federal tax you pay. The person who turned in their taxes early but didnt sign their tax form and got a penalty for it people who tried to do their own taxes only to miss multiple tax breaks and people who just dont pay their taxes every year.

6 Fabulous Ways Successful People Pay Way Less In Taxes

6 Fabulous Ways Successful People Pay Way Less In Taxes

If you invest enough to make a living from taxable gains you will pay less in taxes than many people who make much less than you do.

/dotdash_Final_Countries_with_the_Highest_and_Lowest_Corporate_Tax_Rates_Nov_2020-01-671165481d094f6bb0a0c363689bfa67.jpg)

How to pay the least amount of taxes. Contribute to a 401 k 403 b 457 Plan or IRA. Make Student Loan Payments. So Im here to help you learn how to pay the least amount of tax that you can while keeping yourself out of jail.

Have savings in both tax-deferred retirement accounts like 401 k plans or IRAs and after-tax savings such as a brokerage account. The less expensive option is to hold on to your investment for over a year. You simply specify a certain withholding amount a possible W-4 entry and additional bits of information and the tool estimates your tax liability.

Okay okay maybe jail is just a little extremebut I promise that when you make 40000 a year in your business and an agent hands you a 70000 tax bill jail sounds like the best option just to make that nightmare go away. Decrease your tax bill. In recognition of this fact the IRS lets owners of these sorts of business assets take a deduction each year equal to an estimate of how much the asset went down in value that year.

They could also invest in municipal bonds funds annuities and life insurances. Tax is then payable at rates of 0 if below 600 otherwise at 15 or 20 depending on your income. Best Circumstances for Tax-Planning.

The opportunity to pay less in taxes is greatest for individuals who. So now you know where youre paying tax unnecessarily Im going to show you six ways you can stop wasting your money and pay less tax. Tax laws are changing all the time.

Each allowance reduces the amount of your wages that are subject to taxation. Even if you arent required to pay federal income taxes you could get a refund from the government. A good option will also be contributing and participating in a retirement plan account or an individual retirement account IRA such a 401k plan.

Have years where their income might be less such as when one spouse retires mid-year when spouses retire. The earned income tax credit is a refundable tax credit of up to 6660 for tax year 2020. Sometimes in your favor sometimes not.

Being self employed can also lessen the amount one has to pay in income taxes. One problem with saving money in a standard savings account is that you have to pay tax. US President Donald Trump recently signed new laws that made excludes cryptocurrencies from 1031 exchanges.

When it comes to taxes I have seen it all. How to Pay Less in Taxes Legally 1. 7 Tricks to Pay Less in Taxes like the Rich 1 Depreciation Buildings and equipment go down in value over time.

Where to Start. In this case you would get a tax deduction for the higher amount and avoid having to pay about 200000 in gains taxes. The less income you have the lower your taxes will be.

Begin by reviewing lines A through G of the personal allowances worksheet section of your current W-4 to see if you claimed all the allowances that you qualify for. Dont base your long-term plans on the concept of static laws. The 5 Worst Personal Planning Tax Mistakes Ive Ever Seen.

You dont get to use all the money in your traditional 401 k and IRA for retirement because you still have to pay. As long as you hold the asset for at least a year before you sell it your profit will be taxed at special capital gains tax rates that top out at 15 percent. The key to paying the least amount of taxes is to have a great Tax advisor Accountant or CPA.

About 65 of college seniors graduating from public. The Internal Revenue Service IRS provides a Tax Withholding Estimator an online tool that calculates the tax that should be withheld from each paycheck to help you avoid owing taxes at years end.

How To Pay Little To No Taxes For The Rest Of Your Life

How To Pay Little To No Taxes For The Rest Of Your Life

How To Pay Little To No Taxes For The Rest Of Your Life

How To Pay Little To No Taxes For The Rest Of Your Life

8 Ways To Pay Less In Taxes And Save Money

8 Ways To Pay Less In Taxes And Save Money

How To Pay Little To No Taxes For The Rest Of Your Life

How To Pay Little To No Taxes For The Rest Of Your Life

How Fortune 500 Companies Avoid Paying Income Tax

/states-without-an-income-tax-3193345-01-41573651b8a540cd84509ffb3052580c.png) States That Do Not Tax Earned Income

States That Do Not Tax Earned Income

/how-much-do-i-budget-for-taxes-as-a-freelancer-453676_V1-e59e69ce6941454cb1025178eab3574d.png) How Much Should You Budget For Taxes As A Freelancer

How Much Should You Budget For Taxes As A Freelancer

How Much Money Do You Have To Make To Not Pay Taxes

How Much Money Do You Have To Make To Not Pay Taxes

/dotdash_Final_Countries_with_the_Highest_and_Lowest_Corporate_Tax_Rates_Nov_2020-01-671165481d094f6bb0a0c363689bfa67.jpg) Countries With The Highest Lowest Corporate Tax Rates

Countries With The Highest Lowest Corporate Tax Rates

How To Pay Little To No Taxes For The Rest Of Your Life

How To Pay Little To No Taxes For The Rest Of Your Life

How To Pay Little To No Taxes For The Rest Of Your Life

How To Pay Little To No Taxes For The Rest Of Your Life

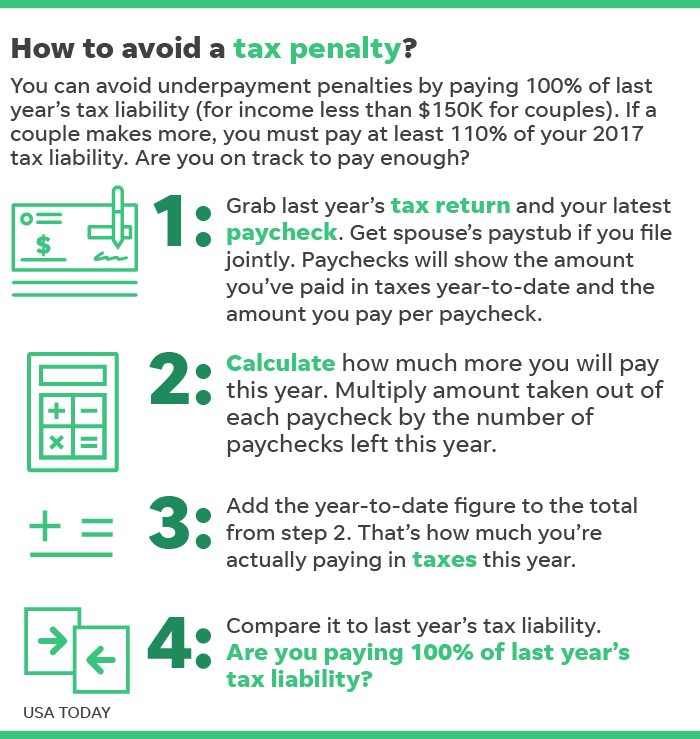

Taxes 2018 Adjust Withholding Now To Avoid Big Bill Next Year

Taxes 2018 Adjust Withholding Now To Avoid Big Bill Next Year

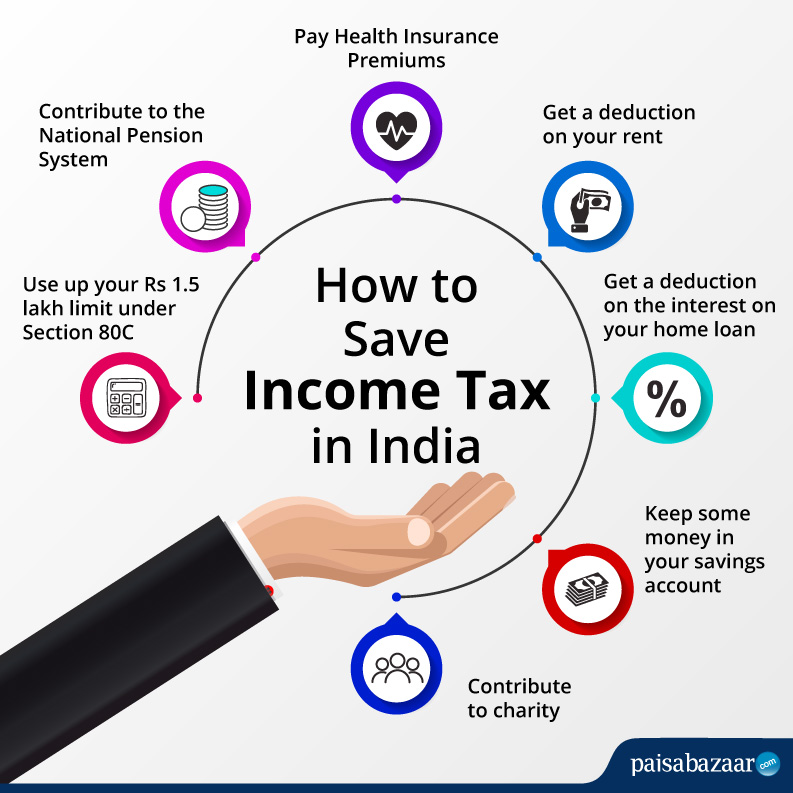

How To Save Income Tax On Salary Tax Saving Schemes Paisabazaar

How To Save Income Tax On Salary Tax Saving Schemes Paisabazaar

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.