The Fund employs a passive management or indexing investment approach through physical acquisition of securities and seeks to track the performance of the Standard and Poors 500 Index the Index. Open a Brokerage Account.

How The S P 500 Became So Overrated Seeking Alpha

How The S P 500 Became So Overrated Seeking Alpha

The minimum investment needed for the S P 500 Index Mutual Fund is 300000.

Invest in vanguard s&p 500. Choose Between Mutual Funds and ETFs. About Vanguard SP 500 ETF. One its made up of large-cap stocks.

This is important because large-cap stocks are bigger ships to. Both index funds and ETFs are similar but there are minor differences. Putting it differently youre buying a tiny portion in each of the companies in the index.

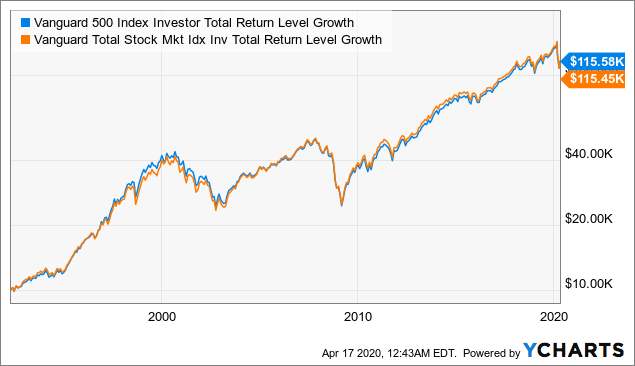

The most common ways to invest in the SP 500 are index funds and ETFs both of these will mirror the SP 500 index. This can be at 200000 if you are investing through an educational savings account. It also has a strong track record and has returned an average of 10 per year since inception.

In order to invest in an SP 500 ETF youll need to open a trading account with a broker or platform. You can buy SP 500 index funds as either mutual funds. The SP 500 index has become a representation of the US.

Choose between ETFs or Mutual Funds. You can buy the SP using index funds or ETFs. Stock market and several mutual funds and exchange traded funds ETFs that passively track the index have become popular investment.

ETF funds are available through all major exchanges. Doing so gives you diversification and decreases portfolio risk. Here are some crucial tips that you will need to consider as you invest in a Vanguard S P 500 index fund.

Additional investments on the index fund inv can be made as small as 100 bucks. There are several reasons why the Vanguard SP 500 ETF is appealing for investors. The Vanguard SP 500 Index ETF CAD-hedged seeks to track to the closest extent possible before fees and expenses the performance of a broad US equity index that measures the returns of large market capitalization US stocks.

It includes just over 500 stocks from some of the largest and strongest companies in the United States. Most people praise the work that Vanguard has done. How to Invest in the SP 500 1.

The SP 500 is one of the best representations of the stock market as a whole. Index funds will tend to have a higher buy-in and many times a lower expense ratio. In order to invest in a Vanguard SP 500 mutual fund you can purchase your shares directly through the company website.

The investment seeks to track the performance of the Standard Poors 500 Index that measures the investment return of. The Index is comprised of large. In fact Vanguard has become synonymous with the low-cost fee model.

The SP 500 is an index comprised of 500 large companies and is a proxy for the US. Choose an ETF to invest in if you decide to invest in an ETF Choose a brokerage or robo-advisor that allows you to invest in the SP 500. How to invest in the SP 500 in Singapore.

The Vanguard SP 500 ETF NYSEMKTVOO aims to mirror the SP 500 itself. A common concern I hear is if it is actually possible to make large investment gains by simply investing in index funds like the SP 500. If you want to invest in the SP 500 youll first need a brokerage account.

Heres a step-by-step guide to start investing in the SP 500 in Singapore. The Vanguard SP 500 ETFs annual expense ratio is just 004 per year or 4 on a 10000 investment. When you invest in the SP 500 youre investing a proportion of your money in all these 500 companies.

That just seems too simple to yield great results. Youll need to deposit funds into your account to begin trading.